Surprisingly, many people are not managing their cash balances as effectively as they should be.

We hear of people having money sitting in a chequing account earning zero interest. These funds might be in cash for emergency purposes, but often the amounts are excessive and earning nothing is not a good option.

Others will have money in a bank savings account that pays very little interest. Knowing what you should earn on cash equivalents is important.

When we talk to clients about the level of cash, they currently have outside of their investment accounts, the answers vary significantly. At times the responses we hear is that they keep a large amount of money in their bank account so they can easily access funds if needed. Essentially, they are wanting the money to be liquid.

Others want money in the bank in the event of an emergency or comfort against market volatility. The features of accessibility should not limit your ability to earn money on your money.

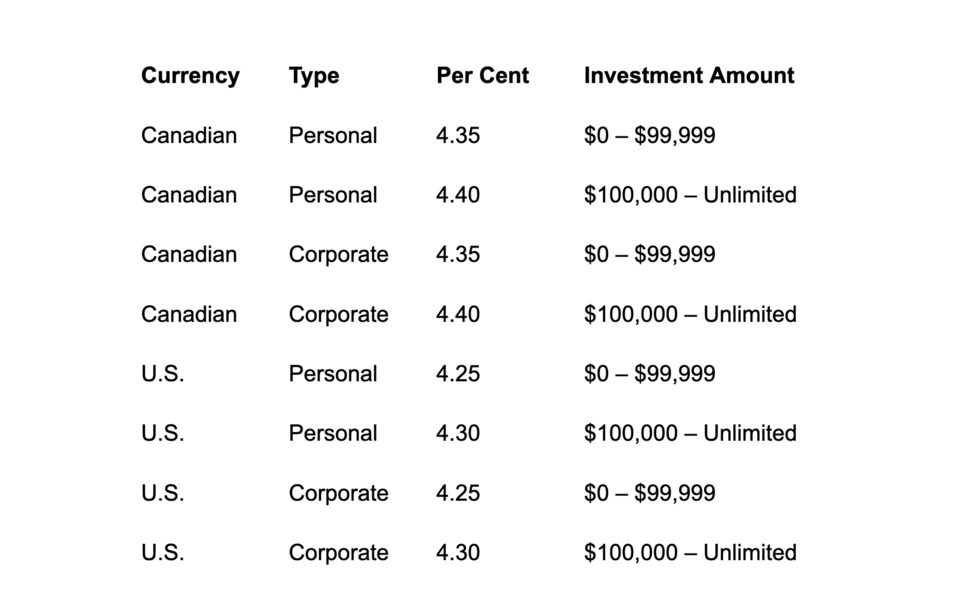

As a Portfolio Manager, we ensure our clients’ cash balances are put into one, or more, Investment Savings Accounts, or ISAs. We use several different types of ISAs depending on the currency and the type of account.

For example, a client may have both Canadian dollars and U.S. dollars — both should be generating significant income.

We have different ISAs depending on whether the cash is in a personal account or corporate account. Many of our business clients may have significant cash balances within their corporation for potential purchases, managing downturns, growth plans, inventory purchases, or fluctuating market cycles. They want the cash balances to earn income, but also need to have the funds liquid and safe.

The ISAs are guaranteed up to the applicable CDIC limits and are extremely liquid. If a client calls us before 12:30 p.m. on a business day, we can transfer money into their bank account on the next business day (one day liquidity). There is no minimum holding period.

Most cashable GICs have a less competitive rate and a minimum 30-day hold to have any interest paid out. Daily interest on an ISA will be calculated by multiplying the applicable annual interest rate by the daily opening balance and dividing that amount by 365 (or 366 in a leap year).

Below are the current rates for our ISA to provide a current benchmark of what you should be receiving. Note the rates are subject to change.

When interest rates rise, the ISA rate is typically adjusted upward. On the flip side, if interest rates decline, the ISA rate is typically adjusted downward.

For our clients with fee-based managed accounts, we do not charge a fee on the ISA balances. We refer to the ISA as cash equivalents.

When we do second opinion reviews for investors we will see significant cash balances, even within investment accounts, that are either not put into an ISA or the advisor chooses to charge a fee on the cash equivalents. We will always comment on how cash balances are currently dealt with as part of the written proposal.

No need to keep money under the mattress

The ISA can provide a great rate of return with safety and liquidity. In our opinion, all significant cash balances should be making the above rates.

Above, we have focused on optimizing cash balances within bank accounts and investment accounts. Some people have cash that is neither in a bank account or in an investment account.

Over the last couple of decades, we have heard hundreds of stories from clients, accountants, lawyers, colleagues, and friends about strange places where people have hidden their cash money. Some of the stories seem unreal — especially the large levels of cash they have — and where they have it. Do people really keep money under their mattresses? The answer to that is yes, some do. Many people have smaller amounts of cash in their homes for things that come up. A smaller group of people have more than a small amount.

Ten stories that stand out

1) This one couple came in and we were talking. The spouse brought up the fact that her husband had buried a significant sum of money in the backyard and has not told her where it is. Her concern was that he would pass away, and she would not be able to find the money. They lived on a large acreage. She had suggested that he leave a map with me, like a treasure map with an “x” marking the spot, so she would know where the money is.

2) Another client came in and told me that their elderly father did not believe in keeping money in a bank. He did not trust the banks and dealt with cash for everything. They said their father kept over $200,000 stored behind the grandfather clock. The kids were concerned about him either getting robbed or the house burning down. From an investing standpoint, that $200,000 could be earning $8,800 annually by simply putting the funds in an ISA.

3) This one client stored little bits of cash throughout her house, inside books, cards, boxes, etc. She felt comfortable knowing that she had these funds available in an emergency. On each of these items, she had a sticker with the name of the person who was to get the item if she passed away. They got the item and a little bit of cash.

4) Some people store important medical papers in their freezer. One client also stored a large sum of money in her freezer, enough to cover the estimated cost of her funeral. The cash was stored in a bag, along with her important legal papers. She had told her executor to open the freezer if anything happened to her. She felt that this was the safest place in the house to protect the cash and legal documents against theft and fire.

5) Many clients keep money in a safe in their home. They will keep United States dollars and other currencies for when they go on trips – often the cash is in the safe for one or more years. The ISA is available in both Canadian dollars and U.S. dollars – why not make some money on your money? The U.S. dollars do not need to be converted.

6) Another person I met had been making money working odd jobs for cash. He thought it would raise red flags if he brought this cash money into the bank, and he didn’t want to answer any questions. He opted to literally “put it under his mattress.” I would imagine that many workers in the underground economy have found creative locations to store their money as financial institutions crack down on unusual transactions.

7) A similar story as above, but this individual spent a good portion of every day calling radio shows for prizes, entering free competitions, and ordering free samples and items online. She would win prizes and get free items, such as gift cards, in the mail that she would subsequently sell the coupons and cards she had received. She had accumulated over $15,000 over the years, and she had stored it at home in a cash box in her closet. She was afraid to bring it to the bank as she had not paid tax on it. She had come in to ask me whether she should have reported these amounts and whether any of these were taxable.

8) One client believed in having three months’ salary in cash in the event he lost his job. He was making good money, had money in the bank and in investment accounts. He regularly added to both his investment account, but the three months salary in cash in his home gave him peace of mind that regardless of what happened to him at work, he felt he could get back on his feet within three months. He kept the location of that money private. Over many years, a significant amount of income is lost using this approach.

9) Another individual I hired for some small jobs would prefer not to take a cheque. He once had his bank accounts seized by CRA and, from that day forward, preferred to work for cash and not have a bank account. When he did get a cheque, he would go to one of those cheque-cashing places and pay fees to get cash in hand. His dislike for CRA was so high that he was willing to never earn money on cash he has and avoid bank accounts.

10) Nearly all kids keep cash in a piggy bank. Some adults I have met have large containers full of coins that they have collected over the years — none of which are earning any income. We have all heard of people keeping money in the traditional hiding spots: cookie jar, envelopes stuffed away, hidden drawer of a desk or cabinet, under a loose floorboard, hidden in the attack, within a spare wallet/purse, in couch cushions, etc. These hidden spots always leave me wondering two things: Firstly, the money is not earning money, and secondly, what would happen to the hidden money if they were to pass away.

(Note: We do not suggest, condone, or recommend any strategy that involves hiding or not declaring funds with the purpose of avoiding paying taxes.)

When we hear of people having large amounts of cash earning little to nothing, the advice we give everyone is always the same. Any large amounts should be deposited into either a bank account or an investment account. We will quantity what they are currently making/not making and what they should be making.

For our clients who have investment accounts with us, the ISA is a great option for all cash balances.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit .