As we enter the last quarter of 2023, it is time to look at whether tax-loss selling makes sense for your portfolio.

During a positive year, several rebalancing trades may have occurred, resulting in realized gains accumulating. When this happens, it is time to look closer at tax-loss selling to reduce the tax liability in the current year.

One or two down years that follow positive years in the stock market often create the ideal environment for tax-loss selling to create a net capital loss to be carried back to prior years. In the case of 2023, any net losses created this year may be carried back and applied against capital gains in 2020, 2021, or 2022.

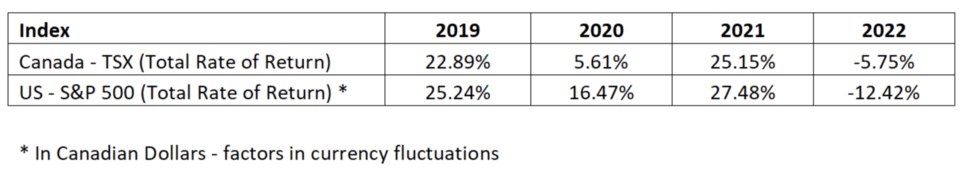

The total rate of return for the major indices in sa国际传媒 and United States for the four previous years are outlined below:

The purpose of tax-loss selling is to reduce current year taxes or to recover taxes paid in the previous three years. At the end of every year, investors may consider whether to sell assets with an accrued loss to offset gains already realized in the current year.

In an event that the losses exceed capital gains in the current year, a “net capital loss” is created. Net capital losses can be carried back up to three years or carried forward indefinitely to offset capital gains.

In order to determine if a tax loss strategy is appropriate, you should speak with both your wealth adviser and accountant.

Start by gathering the following pieces of tax information:

• Unused net capital loss carry forward information.

• Taxable capital gain information for 2020, 2021 and 2022.

• Realized capital gains (losses) for 2023 from selling non-registered investments including stocks, bonds, mutual funds, exchange traded funds and real estate — essentially a preliminary realized gain (loss) report from Jan. 1 to year-to-date.

• Listing of unrealized capital gains and losses on your non-registered investments (those that you still own and have not yet sold).

The following is a quick list of items to factor in when looking at your 2022 tax situation and non-registered investments:

• Mutual fund distributions that typically occur at the end of the year and may include a capital gain component.

• Dividend reinvestment plans should be factored in when determining an average cost for tax purposes.

• If you hold the same security in multiple non-registered accounts, you will have to calculate an average cost for tax purposes.

• Some investments have a return-of-capital component which reduces the original cost that you paid.

• Bonds purchased at a premium will create a capital loss at maturity and bonds purchased at a discount will create a capital gain.

• Investments denominated in a foreign currency should have a cost base that is converted to Canadian dollars.

• If you have any defunct or de-listed securities, determine if you have previously claimed the capital loss.

• Ensure you factor in any elections that you made (i.e. Feb. 24, 1994, capital gains election).

The following outlines some general rules to adhere to before doing any tax-loss selling:

• If you are selling a security to realize a capital loss then you, or an affiliated person (i.e. spouse, corporation), must not purchase the identical security within 30 calendar days — referred to as the superficial loss rule.

• Transferring positions that are in a loss position to your RRSP or TFSA as an “in-kind” contribution will violate the superficial loss rule and the loss would be denied.

• Consider donation of securities in-kind with unrealized capital gains.

• Confirm with an accountant whether to carry net capital losses back to the earlier years, sometimes carrying it forward to a future year may be more advantageous.

To claim a loss on an investment, legal ownership must transfer in the same calendar year. Two terms to remember are trade date and settlement date.

Trade date is the day that you or your wealth adviser entered the sell or buy order. Legal ownership has not transferred technically at that point.

Settlement is the date in which legal ownership has transferred. In the past, investors in sa国际传媒 would often have to factor in different settlement dates for U.S. and Canadian markets when looking at tax-loss selling options near the end of the year. The primary reason for this is that the U.S. does not recognize Boxing Day as a holiday.

Starting in September 2017, both the U.S. and Canadian market participants saw the transition to a two-business day (T+2) settlement consistent with many other countries. Most security transactions take two business days to settle after the trade is entered. For the 2023 income tax year, the last day to sell Canadian or U.S. stocks is Dec. 27.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit .