One of the most important components to investing is diversifying your investments geographically and managing currency exposure.

Below are a few tips we utilize with our clients to reduce conversion costs, which ultimately leads to greater performance. Most of our conversions are between the Canadian dollar (CAD) and the United States dollar (USD).

Tip 1 — Settlement in both CAD and USD

Settlement in both CAD and USD is a surprisingly simple tip that many investors miss. Ensuring correct settlement is perhaps one of the most important steps to reducing costs. For those who have always trades settled on the CAD side, this discussion will be an important read.

When investment accounts are opened with Wealth Advisers and Portfolio Managers, they start with a zero balance. When trades are done in an account, an adviser must choose the settlement currency, typically either CAD or USD. It is possible to settle all trades in CAD, in which case when you look at your investment statement for an account, you will see everything on one statement priced in CAD.

It is possible to settle Canadian equity buys in CAD and US equity buys in USD. When a Wealth Adviser or Portfolio Manager settles in both currencies, the client will have two sides to an investment account — the CAD side that holds the Canadian investments priced in Canadian dollars; and a USD side that holds the United States investments priced in US dollars.

Why does settlement matter? In our article A Primer on Currencies and Investing, we covered topics such as the bid rate, mid rate, ask rate, and spread. These terms are particularly important when settlement is only in CAD. Below are two scenarios assuming that the bid rate is 1.37, mid rate is 1.35, and ask rate is 1.33. The difference between these rates is considered the spread.

Settlement in CAD

Wendy purchases 100 shares of Costco, a U.S. company, at $589.08 per share. As the trade is done on the CAD side, the exchange rate that is used 1.37. The total cost for Wendy is $80,703.96 (100 x $589.08 x 1.37).

Wendy then chooses to sell the investment next month when Costco is at the same price of $589.08 per share. We will assume that the currency rates are the same. The total proceeds that Wendy would receive is $78,347.64 (100 x $589.08 x 1.33). The currency conversion cost is $2,356.32 for this one transaction.

If Wendy wanted to purchase another U.S. company, the conversion to buy would be at 1.37. This cycle continues in perpetuity if settlement of foreign securities is done in CAD. To save currency conversion costs, we recommend clients settle U.S. trades in USD.

Settlement in USD

John purchases 100 shares of Alphabet, a U.S. company, for $140.02 per share. John chooses to settle his trade on the USD side. This first trade will result in John having to pay a bit of a spread above the mid rate. The total cost for John is $14,002 USD.

When John chooses to sell Alphabet, it is on the U.S. side of the account, and our recommendation is to settle the trade in USD. This will enable John to purchase another U.S. company with the USD without having to pay any further conversion costs.

Dividend and Income Payments

If a U.S. security has been purchased and settlement was in CAD, then this means that all dividends received on the security will, with every payment, get converted to CAD.

To illustrate, let’s assume a USD company pays a dividend of $500 USD every quarter. If settlement for the underlying investment was in USD, then $500 USD will simply be paid as $500. If the USD company is held on the Canadian side of the account, then the dividends each quarter must be converted to CAD. Using the above ask rate, the account would show $665 CAD ($500 x 1.33).

Our recommendation is to have US securities settle on the US side of the account to enable all dividend and income payments to be paid in US dollars and remain in US dollars with no currency conversion spreads.

Tip 2 — Timing of purchase

When we take on new clients, we will discuss with them currency risk and timing of when to purchase USD. All to often the decision to purchase USD is done in conjunction with purchasing a U.S. security.

For example, if you purchase $20,000 of Pepsi, and wish for it to settle on the U.S. side, you must convert funds within two days from Canadian to USD.

Although this approach is very common, we feel a better approach is to separate the transactions. We feel that the purchase of USD is one decision, and another decision is whether to purchase a U.S. company. Often when the U.S. stock market is going up, the USD is going down, and vice versa. Taking advantage of swings in the currency and adding USD on weakness is our recommendation.

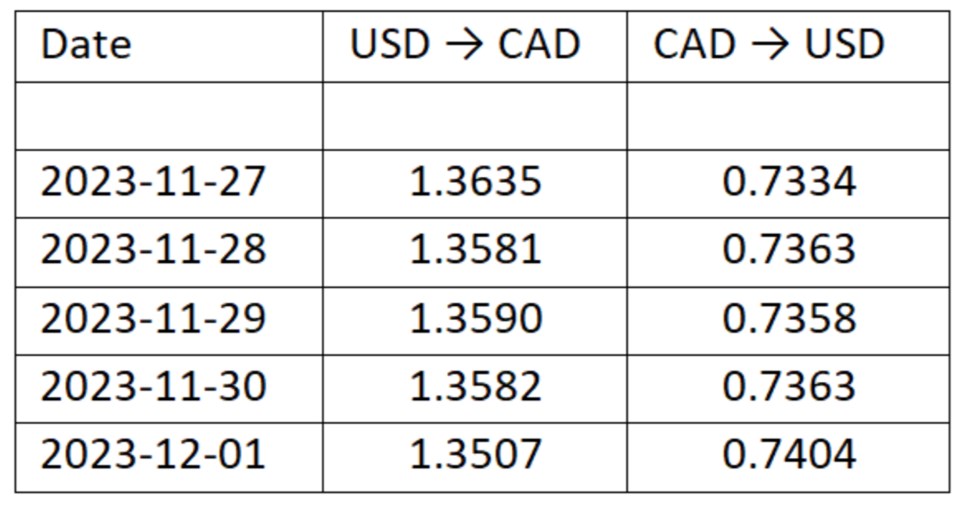

The best external website we recommend people visit is the to obtain the actual exchange rates, whether you are converting USD to CAD or whether you are converting CAD to USD. The website will give you the daily exchange rates for both directions.

Similar to monitoring the time of purchasing an equity, we also recommend monitoring currencies and time when you do conversion which do not necessarily coincide with a recent equity purchase.

Tip 3 — Buying larger quantities

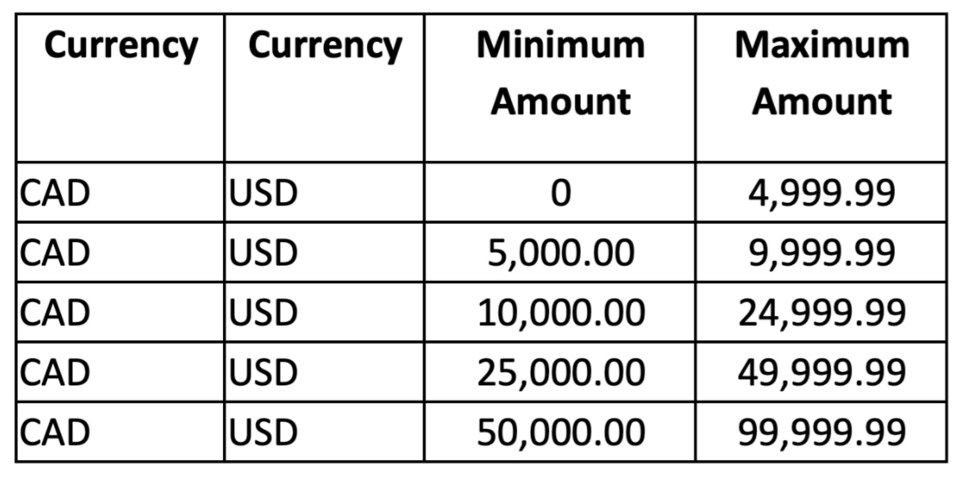

As a Portfolio Manager, we have tools to access currency rates for our clients and set alerts. Foreign exchange rates on our systems are typically broken down into the dollar amount that you wish to convert. The greater the dollar amount you want to convert the lower the spread.

For example, if a person was wanting to convert $4,000 from CAD to USD, the conversion rate would be higher than if a person was wanting to convert $50,000 from CAD to USD.

We also have a foreign exchange desk that we can call and request preferred rates for larger quantities being converted. Whenever we are doing trades, where the conversion amount is equivalent to USD $100,000 or more, we have the ability to call our foreign exchange trading desk for a preferred rate. The one take away we tell clients is that the greater the amount you convert the better the rate.

Reasons for conversions between CAD and USD

Throughout our clients investing years, there will be reasons to increase USD and reasons to reduce USD. Below we have outlined the common reasons for converting in both directions.

Top 5 reasons to convert CAD to USD

1) To obtain exposure to U.S. companies which represents nearly 42.50 per cent of the global equity market (sa╣·╝╩┤½├Į represents approximately 2.70 per cent)

2) To reduce volatility in a diversified portfolio

3) To take advantage of a trade opportunity if you feel the USD will appreciate in value relative to the CAD.

4) Purchasing an investment property in the US.

5) For non-investment purposes such as travel, transferring funds to family, and shopping.

Top 5 reasons to convert USD back to CAD

1) Strength in the U.S. market can often at times result in rebalancing trades that create excess U.S. cash.

2) If the Canadian market has been weaker than the U.S. market, then it can be strategic to allocate some of those dollars to sa╣·╝╩┤½├Į.

3) Cash flow needs may be needed in Canadian dollars and cash in the account is primarily USD.

4) Clients that work or sell products in the U.S. often get paid in U.S. dollars or clients that receive pension income from the U.S.

5) Placement of investment income may result in shifting USD securities that pay dividends out of a non-registered account into a registered account to take advantage of taxation and replace with Canadian dividend paying stocks.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Adviser and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit .