NEW YORK (AP) ŌĆö The vast majority of Americans will find multiple options for health insurance coverage for 2023 on HealthCare.gov after under the Affordable Care Act.

People searching for plans on the government marketplace should consider their budget, health, doctors and a variety of other factors before picking a plan.

Currently, get their health insurance through the ACA, commonly known as ŌĆ£Obamacare.ŌĆØ The number swelled during the coronavirus pandemic after Congress passed generous subsidies to make coverage more affordable.

While most people have three or more options, about 8% of participants will choose from only two insurance carriers, a number that drops to one in rural counties across Alabama, Alaska, Arizona and Texas.

According to the Biden administration, 80% of consumers should be able to find a plan for $10 or less per month after tax credits.

HereŌĆÖs a look at navigating the Affordable Care Act marketplace:

HOW DOES THE MARKETPLACE WORK?

The ACA marketplace is geared toward people who don't have health insurance through their job, Medicare, Medicaid, the ChildrenŌĆÖs Health Insurance Program or another source.

While most states use the federal marketplace at HealthCare.gov, some have set up their own. These are: California, Colorado, sa╣·╝╩┤½├Įicut, Idaho, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New Mexico, New York, Pennsylvania, Rhode Island and Vermont plus the District of Columbia.

Premium tax credits and other savings reducing the cost of insurance are and the number of people in your family. For example, individuals with an annual income between $13,590 and $54,360 are eligible for a subsidy. Those who make less than that qualify for Medicaid.

You can use to determine what savings are available to you.

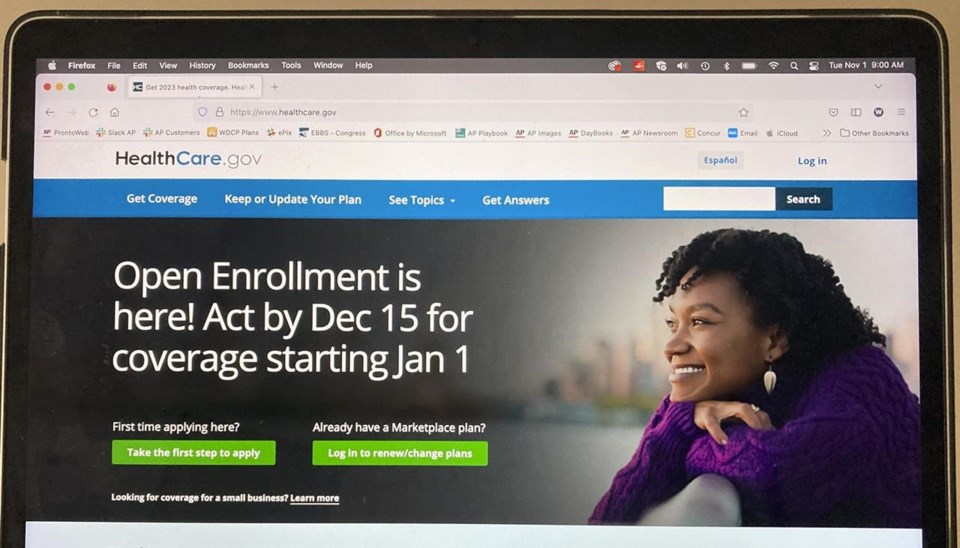

Know the deadlines for coverage in 2023: Dec. 15 for coverage that starts on Jan. 1 and Jan. 15 for coverage that begins Feb. 1.

WHAT TO LOOK FOR IN CHOOSING A PLAN

Shop around, even if you're currently covered under the ACA.

First, youŌĆÖll want to see what the monthly premium ŌĆö the amount you pay for coverage ŌĆö will be.

Next, check on the planŌĆÖs deductible ŌĆö thatŌĆÖs what you pay up front for health services before your insurance begins to share some of the remaining costs for the year.

Look into the planŌĆÖs copayments or coinsurance. Those are the the fees you pay every time you visit the doctorŌĆÖs office or go to an urgent care clinic, for example. Plans with coinsurance can be trickier to budget for because you pay a percentage of the service cost, instead of a set fee.

And make sure to know the out-of-pocket maximum. After you hit that number, your insurance will cover 100% of costs. YouŌĆÖll want to keep that number in mind if you might have big health expenses ŌĆö a major surgery, childbirth or ongoing therapy or treatment ŌĆö in the upcoming year.

ŌĆ£Consider whether you are going to have an expensive year," said Kelly Rector, an insurance broker and president of Missouri-based Denny and Associates Inc. ŌĆ£If you know youŌĆÖre going to be hitting that out-of-pocket max no matter what, maybe you look at the lower premiums and higher deductible plan.ŌĆØ

DOES YOUR DOCTOR PARTICIPATE IN THE PLAN?

Do you want to continue seeing a favorite doctor or need a prescription drug covered on your plan?

HealthCare.gov also offers search features and tools for you to check whether your doctor or prescription drugs are covered under specific plans.

Those are ŌĆ£the biggest thingsŌĆØ that Rector recommends consumers check when searching the marketplace.

WHAT LEVEL PLAN SHOULD I CHOOSE?

, including preventive services, prescription drugs, mental health services and pregnancy.

There are four levels of plans offered: bronze, silver, gold and platinum. Bronze plans have the lowest premiums but the highest out-of-pocket costs. Premium costs increase as you go up the medal ladder, but deductibles are lower.

The best deal for people who qualify for extra savings is a silver plan, said Cynthia Cox, the Kaiser Family FoundationŌĆÖs director for the Affordable Care Act program.

ŌĆ£If youŌĆÖre just barely making above the poverty level, you really should be buying a silver plan, with the lowest premiums, lowest deductibles,ŌĆØ Cox said.

In some cases, those plans will still be nearly free and will have much lower copays and deductibles, making for the best deal in the long run. Depending on your income, you might have to pay a monthly premium of $15 to $20, but the lower costs to the overall plan still make a better deal, Cox said.

For people in higher income brackets, shop around before selecting a plan. Your subsidies won't be as big ŌĆö if you qualify at all ŌĆö and the plans will be pricier.

If youŌĆÖre young and healthy and donŌĆÖt anticipate significant health care needs, the bronze plan remains a reasonable choice, according to Rector. High-deductible "catastrophic plansŌĆØ are also available to people under age 30.

WHAT IF I HAVE QUESTIONS ABOUT MY SPECIFIC SITUATION?

In each state, people known as ŌĆ£navigatorsŌĆØ provide free consultations to help you choose a health insurance plan. The program is supported by public funding. You can on HealthCare.gov. Agents and brokers are also available to help. They do charge fees but typically provide their services for free to consumers and charge the insurance companies instead.

___

Seitz reported from Washington.

___

The Associated Press receives support from the Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab & Co. Inc. The AP is solely responsible for its journalism.

Cora Lewis And Amanda Seitz, The Associated Press