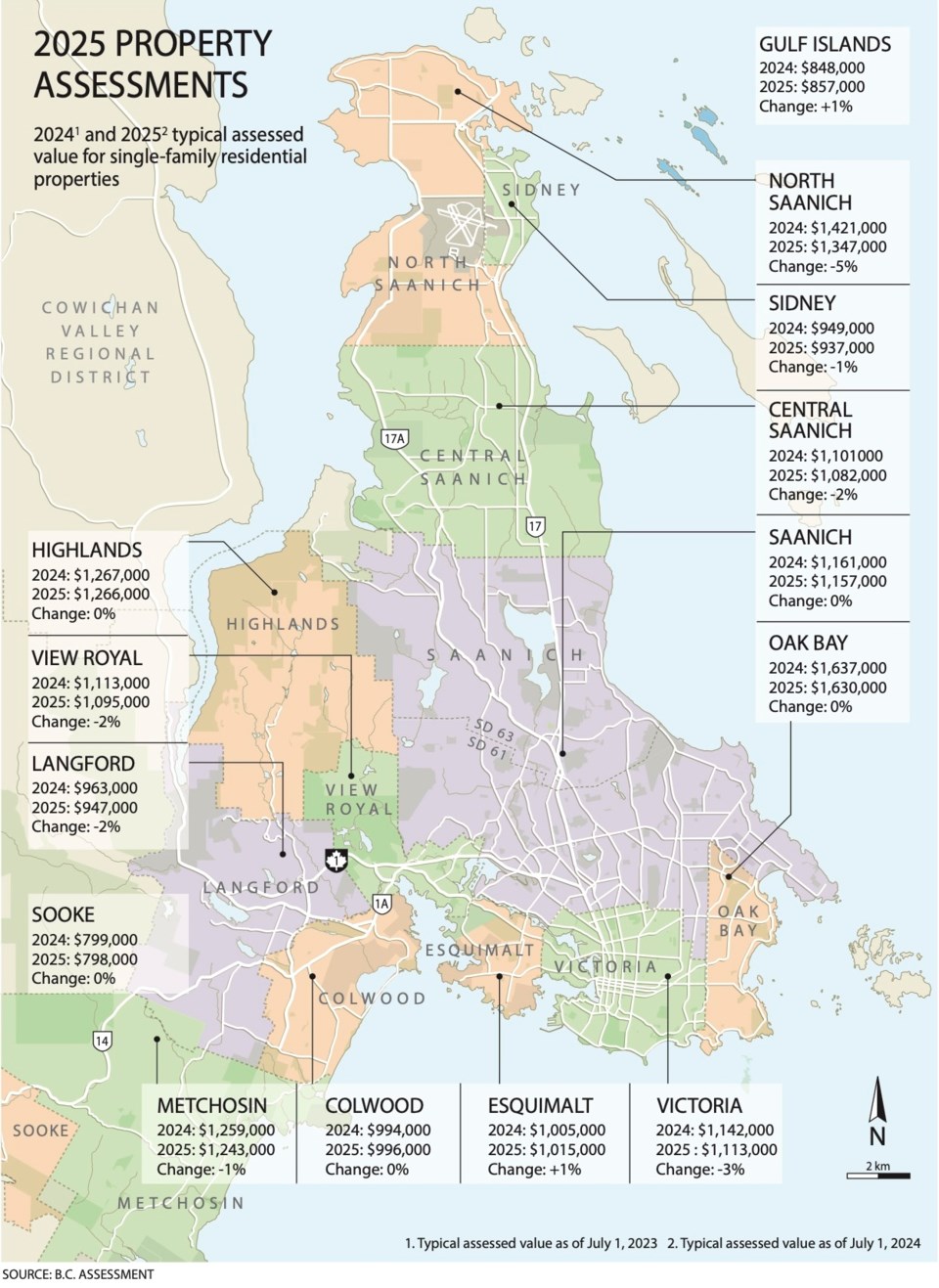

The vast majority of residential property owners in Greater Victoria are likely to see very little change in values when the 2025 property assessment notices start finding their way to mailboxes this week.

Most homeowners will see either no change or slight drops in the assessed values of their homes, while only the Township of Esquimalt will see an increase in the assessed values of single-family homes this year.

The assessed value of a typical single-family home in Esquimalt increased one per cent to $1.015 million on this year’s roll.

“It was a relatively flat year, pretty much across British Columbia,” said Matt Butterfield, deputy assessor for Vancouver Island. “There were very modest changes in assessment, about minus five to plus five (per cent) and that’s been a pretty steady trend across the whole province. On the Island it was the same — very steady and modest changes in assessments, minus five to plus five per cent.”

Butterfield said the outliers were some small communities on the north Island.

“Some of the smaller communities saw some larger changes,” he said, noting that likely reflects strong demand for property in those markets.

The assessed value of a typical home in the Village of Tahsis for example increased by 23 per cent to $201,000 this year, while Alert Bay saw values increase 10 per cent to $300,000 and Zeballos increased nine per cent to $153,000.

Butterfield would not get drawn into what may have shaped the markets, saying it’s not their job to speculate but to look back and reflect what the market’s been doing.

“We’re always looking backwards,” he said.

Homeowners in municipalities in Greater Victoria, other than Esquimalt, will either see no change or slight drops of between one and five per cent.

The largest decrease was five per cent in North Saanich where it dipped to $1.347 million from $1.421 million last year, while Victoria saw a three per cent slide to $1.113 million.

The typical assessed value of strata condominium and townhouse units was down across the board between one and five per cent in Greater Victoria with Central Saanich, Saanich and Oak Bay all seeing a one per cent drop in assessed value. Victoria saw a drop of three per cent and North Saanich condos dropped by five per cent.

The most valuable strata unit in the capital region is a penthouse at the Customs House project at 888 Government St., which was assessed at $9.73 million.

The Island’s total assessment value increased to $391 billion from about $386 billion last year. About $4.89 billion of that is from new construction, subdivisions and the rezoning of properties.

The total value of real estate on the provincial roll — about 2.2 million properties — is about $2.83 trillion, an increase of nearly one per cent from 2024.

The generally flat values of property in the capital region — a mix of small decreases and one modest increase — could be a reflection of a real estate market affected by high interest rates.

The assessment is the estimate of a property’s market value as of July 1 and physical condition as of Oct. 31.

The Bank of sa国际传媒 only started cutting interest rates in June. It reduced its rate five times between June and the end of last year, with the prime lending rate ending the year at 3.25 per cent, the lowest in two years.

Veteran real estate agent Karen Dinnie-Smyth, of Remax Camosun, said the 2024 real estate market was more balanced than slow.

Dinnie-Smyth, who had not seen the assessment figures, said there was more inventory on the market and there was a return to more predictable sales patterns in 2024. There was also an increase in activity later in the year, which could have been the result of interest rate cuts.

She said there has been more optimism in the market, which could carry over into this year as interest rates could continue to drop and a federal election could translate into more consumer confidence.

But Dinnie-Smyth warned there are potential headwinds and it remains to be seen what effect the economic policies of U.S. president-elect Donald Trump will have on the economies of both the U.S. and sa国际传媒.

>See PROPERTY VALUES, A2

>How 2025 assessments compare across sa国际传媒, A4

Each year, assessors take into account current sales in an area, as well as the size, age, quality, condition, view and the location of a property when making the valuations.

sa国际传媒 Assessment stresses that changes in assessed value do not necessarily mean higher property taxes since taxes are affected only by how the assessment changes relative to the average change in that community — a higher-than-average increase might bring higher taxes.

Anyone who thinks their property assessment does not reflect market value as of July 1, or who sees incorrect information on their notice, is advised to contact sa国际传媒 Assessment. If they are not satisfied after that, they can submit an appeal.

Property assessment review panels, which are independent of sa国际传媒 Assessment, are appointed annually by the province and meet in February and March to hear complaints.

The deadline to file an appeal of an assessment is Jan. 31.

sa国际传媒 Assessment said more than 98 per cent of property owners accept their property assessments without a review.

“If anyone does have a concern about their assessed value, we’re really happy to talk to people,” said Butterfield, noting they encourage all homeowners to check out the website, which has more information and features, like being able to pull together multiple properties for comparison, to allow homeowners to better understand how the assessment is put together.

The residential property in the capital region with the highest assessment this year was again James Island, at $57.526 million, down from $57.93 million last year. That property is listed as the third most expensive in the province.

At the top of the provincial list is the Point Grey mansion of Lululemon founder Chip Wilson, whose home at 3085 Point Grey Rd. increased in value this year to $82.66 million from $81.76 million last year.

The most valuable single-family home in the capital region this year is 3160 Humber Rd. in Oak Bay, which was assessed at $17.286 million, edging out last year’s top-assessed property 1850 Land’s End Rd., which this year was assessed at $16.76 million.

According to sa国际传媒 Assessment, the most valuable commercial property in Greater Victoria this year is 3440 Saanich Rd., Uptown shopping centre, which is assessed at $326.8 million, ahead of Mayfair Shopping Centre at $232.8 million.

Butterfield said commercial and industrial properties followed the same trend as residential this year, with only minor changes in assessed value.

“Vancouver Island is looking at zero to five per cent increase in on commercial and industrial properties,” he said.

Based on the assessment data, the province has increased this year’s homeowner grant threshold by $25,000 to $2.175 million. That means any homeowner with a property valued below that threshold may claim the grant to lower their property taxes.

In the capital region, the regular grant is $570. Seniors in the capital region may qualify for a grant of $845.

According to the province, 92 per cent of all homeowners are eligible for the basic grant.

The newly released 2025 property assessment details can be searched and accessed any time at .