TORONTO ŌĆö When Jenny Dickson goes grocery shopping, they only buy off-brand foods or items on sale for fear of overestimating how much money they have available in their bank account.

ŌĆ£This anxiety around doing math can get so intense that I have a panic attack in the middle of the grocery store or just straight up dissociate,ŌĆØ said Dickson, a 28-year-old librarian in Deep River, Ont., who uses they/them pronouns.

Dickson used to live on their own, but moved back in with their parents five years ago when the mental and financial strain of keeping track of rent and bills became too overwhelming.

"My overall anxiety went way down because I wasnŌĆÖt constantly having to worry whether or not IŌĆÖd be homeless because I did my math wrong. I donŌĆÖt trust myself to be able to budget well enough to move out now and my job isnŌĆÖt very well-paid as it is," Dickson said.

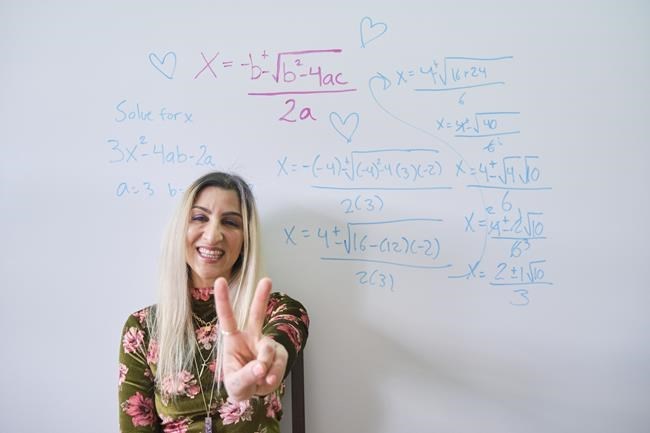

People who are anxious about math can feel nervous, scared or panicked when faced with anything involving math, and that can impact how they handle their finances, said Vanessa Vakharia, founder of the Math Guru, a tutoring studio, and podcast host of Math Therapy.

ThereŌĆÖs an idea, often portrayed in the media, that people with math skills solve problems without much hard work or effort, she explained. This can cause people to feel bad at math if theyŌĆÖre not immediately able to solve math problems.

That feeling can be worsened by the false belief that mathematical intelligence is an indicator of overall intelligence, she added.

ŌĆ£If someone is really good at painting, we donŌĆÖt call them smart. If someone is good at math, you automatically assume theyŌĆÖre intelligent,ŌĆØ Vakharia said.

As a result, people may be scared to make math mistakes because of the associated shame of feeling not intelligent enough or good at math.

"ThereŌĆÖs an approach of, ŌĆśwell, IŌĆÖm not even going to try. The thought of budgeting or investing is too intimidating to me. I hate the word math and I hate numbers, so IŌĆÖm not going to bother,ŌĆÖ" Vakharia said.

People who avoid their finances because of math anxiety might end up overspending and accumulating debt. They also might avoid learning about financial concepts that could improve their finances, such as compound interest when it comes to saving, or learning about investing and insurance.

To reduce math anxiety, the first step is facing your ŌĆ£math trauma,ŌĆØ Vakharia said, which she described as a trauma response to a rattling experience in the past involving math.

ŌĆ£It could be that time you got called on in class and you didnŌĆÖt know the answer, and some kid made fun of you and ever since you carried that shame with you,ŌĆØ she said.

Vakharia said those struggling with math anxiety need to say to themselves: ŌĆ£At some point in my life I was made to feel incapable of math and that is not true.ŌĆØ

From there, itŌĆÖs about taking the steps to learn the information you need, which luckily does not require taking a math class, she said.

Vakharia recommends finding a kind, patient person in your life who appears to be comfortable or good with money, and then asking them if theyŌĆÖd be open to spending some time answering questions about how they budget, manage their money or any other financial topic.

After that first step, it can be easier to determine what resources to turn to next, whether thatŌĆÖs a financial adviser, a math tutor, a budgeting app or educational content.

While Dickson still struggles with confidence in their ability to do math, they have become more confident in asking for help.

ŌĆ£I ask my boss to look over my time sheet to make sure it makes sense before submitting it. I ask my Dad to do my taxes. If you ask, there are people who are willing and able to help. I have a lot less shame around my math anxiety than I used to,ŌĆØ they said.

Dickson has also found it helpful to have a calculator on their phone, which keeps a record of past calculations.

ŌĆ£I can see whether or not IŌĆÖve made any mistakes a lot more easily. ItŌĆÖs nice to have that proof that I donŌĆÖt mess up as often as I think I do.ŌĆØ

This report by The Canadian Press was first published Jan. 25, 2022.

Leah Golob, The Canadian Press