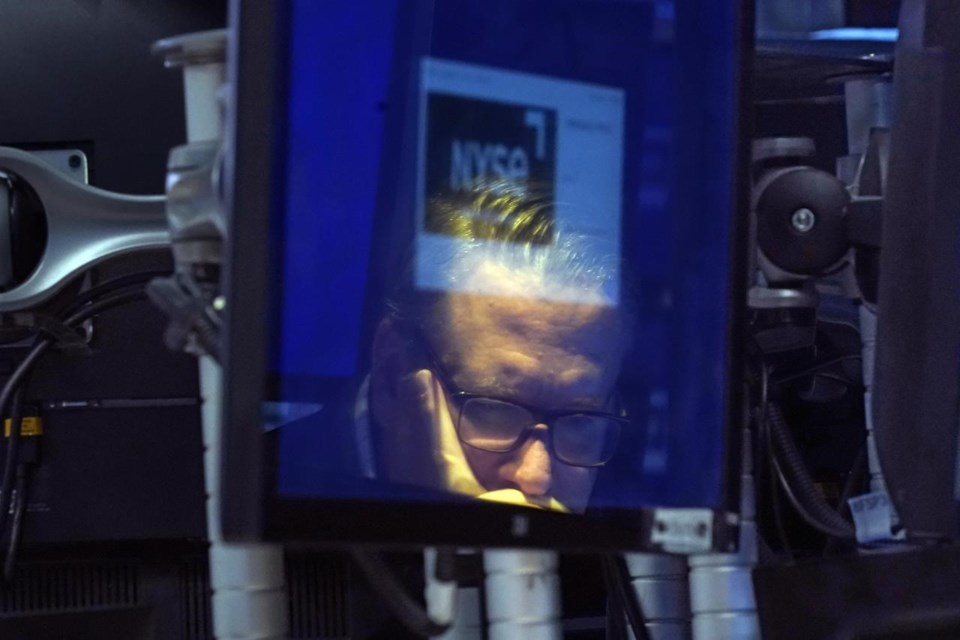

NEW YORK (AP) ŌĆö Stocks closed lower on Wall Street, pulling the S&P 500 down 10% from the peak it reached in July. That puts the benchmark index into whatŌĆÖs called a ŌĆścorrection.ŌĆÖ The declines came amid the latest batch of earnings from big technology and energy companies and some mixed readings on the economy. The S&P 500 fell 0.5% Friday, its 10th loss in the last 12 days. The Dow fell 366 points, and the Nasdaq composite rose 0.4%. Treasury yields held steady following a mixed report on inflation, consumer spending and incomes. Higher yields in the bond market have been helping to knock stocks lower since the summer.

THIS IS A BREAKING NEWS UPDATE. APŌĆÖs earlier story follows below.

NEW YORK (AP) ŌĆö Wall Street slipping Friday following the latest batch of corporate earnings and some mixed readings on the U.S. economy.

The S&P 500 was 0.6% lower in afternoon trading, coming off its ninth loss in 11 days and its lowest level in five months. The Dow Jones Industrial Average was down 339 points, or 1%, as of 1:56 p.m. Eastern time, and the Nasdaq composite was 0.2% higher.

Stocks have struggled recently for a couple reasons: Several Big Tech stocks tanked following profit reports for the summer, and in the bond market tightened their vise on Wall Street.

The S&P 500 has slumped about 4% in October raising concerns about where the market may be headed in the final months of 2023.

ŌĆ£What you have is an oversold market, by any metric,ŌĆØ said Quincy Krosby, chief global strategist for LPL Financial. ŌĆ£That typically leads to a significant rally, but the question is, does that bring you to the end of the year.ŌĆØ

The market got some relief after . Both its profit and revenue for the summer were better than expected. As one of the most massive companies on Wall Street, AmazonŌĆÖs stock movements carry huge weight on the S&P 500 and other indexes.

ItŌĆÖs one of the ŌĆ£Magnificent SevenŌĆØ Big Tech stocks that was responsible for much of the stock marketŌĆÖs climb early this year. But those huge gains also meant big expectations built for them, and , and all fell sharply following their latest reports.

Intel, which is outside the Magnificent Seven, was also helping to support the market. It rose 9.1% after reporting much stronger profit for the summer than analysts expected.

Big Tech stocks have faced an additional challenge as Treasury yields have soared since the summer. When bonds are paying more in interest, prices for most investments fall because investors suddenly have more alternatives for their dollars. Among the hardest hit are stocks seen as the most expensive or requiring their investors to wait the longest for big growth.

That tends to hurt stocks in Big Tech, biotechnology and other high-growth areas in particular.

The yield on the 10-year Treasury was ticking higher Friday following a suite of data on the U.S. economy. It rose to 4.84% from 4.84% late Thursday.

Several big companies slipped after reporting disappointing earnings for their latest quarters. fell 1.4% after reporting a bigger drop in profits than Wall Street expected. Chevron fell 6% after also falling short of analysts' profit forecasts.

stumbled 11.5% after reporting disappointing earnings and revenue a day after it reached a tentative contract agreement with the United Auto Workers union.

The market has been unforgiving when it comes to the latest round of corporate earnings, though they have mostly been solid, said Krosby. Analysts polled by FactSet expect earnings growth of about 2.4% overall for companies in the S&P 500.

ŌĆ£This market has been looking at every single component of what companies are saying,ŌĆØ Krosby said. ŌĆ£You could see this is a market that is very careful about rewarding companies.ŌĆØ

A report showed that the preferred by the Federal Reserve remained high last month, but within economistsŌĆÖ expectations. It also showed spending by U.S. consumers was stronger than expected, even though growth in their incomes fell short of forecasts.

A separate report said that U.S. consumers' expectations for inflation in the coming year are rising, up to 4.2% from 3.2% last month. That's particularly concerning for the Federal Reserve, which fears such expectations could lead to a vicious cycle that worsens high inflation.

Added all together, the data didnŌĆÖt change Wall StreetŌĆÖs expectations much for the Federal ReserveŌĆÖs next move on interest rates.

The Fed has yanked its main interest rate above 5.25% to its highest level since 2001 in hopes of slowing the economy and hurting investment prices enough to starve high inflation of its fuel. But itŌĆÖs been on hold recently, keeping rates steady at its last meeting in September.

The overwhelming expectation is still for the Fed to hold rates steady again next week, and Wall Street is beginning to prepare for rates to stay high for a long time.

The 10-year yield has been catching up the FedŌĆÖs main overnight interest rate as the economy remains remarkably solid and as worries rise about how much debt the U.S. government is taking on to pay for its spending.

The swift rise, up from less than 3.50% in the spring to more than 5% earlier this week, has sent prices tumbling for older bonds already trading in the market.

In the biggest picture, the ŌĆ£bond bubble has poppedŌĆØ following years of ultra-low yields, according to Michael Hartnett, investment strategist at Bank of America.

But he also warned that markets can remain stuck in trading ranges for a long time following bubble bursts before making major recoveries, such as Japanese stocks after 1989 or internet stocks after 2000. He said in a BofA Global Research report that bond yields may not have a long-term run back lower until Washington, D.C. gets ŌĆ£serious about fiscal discipline.ŌĆØ

In stock markets abroad, indexes were mostly lower in Europe after rising more solidly in much of Asia.

___

AP Writers Zimo Zhong and Matt Ott contributed.

Stan Choe And Damian J. Troise, The Associated Press