TORONTO ŌĆö The Body Shop sa╣·╝╩┤½├Į Ltd. is seeking creditor protection and closing a third of its stores because its parent company stripped the Canadian arm of cash and pushed it into debt, according to court documents.

An affidavit published through the company's court monitor from Jordan Searle, who heads the Canadian arm, describes how troubles befell the retailer, whose parent company The Body Shop International Ltd. was bought by European private equity firm Aurelius for ┬Ż207 million ($355 million).

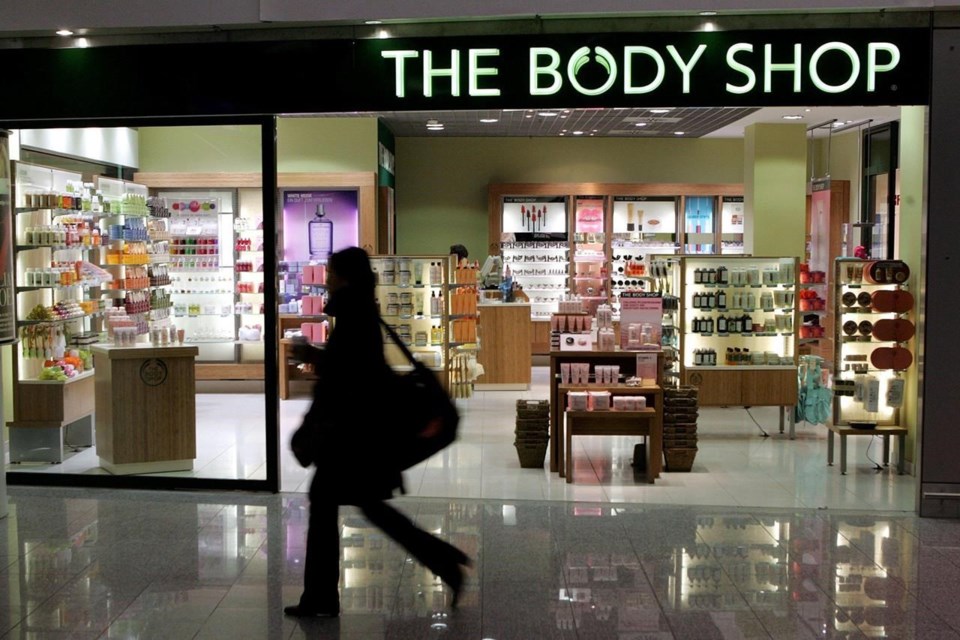

The Body Shop sa╣·╝╩┤½├Į announced Friday it will close 33 of its 105 stores and its e-commerce operations as it seeks to restructure itself under the Bankruptcy and Insolvency Act. The news came just weeks after its parent company filed for creditor protection in Britain.┬Ā

The Canadian branch had 784 workers before the filings were made and about 200 will be laid off by the end of March, according to the court documents. Twenty head office employees and two contractors had their employment terminated Friday, the documents show.

Now, the longevity of the 48-year-old international company known for its cruelty-free skin care products hinges on its ability to restructure in several markets.

In sa╣·╝╩┤½├Į, where The Body Shop has been a mall stalwart since 1980, finding a path forward could involve untangling the company's finances.

The affidavit from Searle, who has been The Body Shop sa╣·╝╩┤½├ĮŌĆÖs general manager since February 2023 and also runs its U.S. affiliate, said the retailer's parent company had ŌĆ£full controlŌĆØ of The Body Shop sa╣·╝╩┤½├ĮŌĆÖs inventory, human resources, accounts payables, cash management and information technology.

Since at least 2007, The Body Shop International used a cash pooling arrangement, where The Body Shop sa╣·╝╩┤½├ĮŌĆÖs funds were regularly sent to the parent company which then took care of its Canadian arm's rent and payroll obligations, Searle said.┬Ā

ŌĆ£The cash pooling arrangement has allowed The Body Shop sa╣·╝╩┤½├Į to operate with little to no institutional debt, helping it to weather a particularly difficult period for the retail industry: the COVID-19 pandemic,ŌĆØ the affidavit said.┬Ā

ŌĆ£Emerging from the pandemic, The Body Shop sa╣·╝╩┤½├ĮŌĆÖs performance has shown significant improvement and was on track to being cash-positive by the end of this year.ŌĆØ

The Body Shop sa╣·╝╩┤½├ĮŌĆÖs situation ŌĆ£deteriorated sharplyŌĆØ in December 2023, the affidavit said. The Body Shop International kept taking its money but wasnŌĆÖt paying vendors because it said it had lost access to its financing and was slowing payments to creditors to conserve cash, Searle said.

The Body Shop International filed for administration in the U.K. on Feb. 13. Administration is a legal process that allows companies to restructure or wind down without paying off all its debts.

Asked about The Body Shop sa╣·╝╩┤½├Į's claims, a spokesperson for the joint administrators being used in The Body Shop International's U.K. proceedings said in an email the company had long used cash pooling but that process ceased at the time of the administration "with funds then remaining with each subsidiary entity."

On Monday, the Ontario Superior Court of Justice granted measures including a requirement for the company's suppliers to continue to provide the retailer goods and services while it restructures and permission for stores to cease accepting gift cards and returns.

The Body Shop sa╣·╝╩┤½├Į made about $12 million before interest and taxes in the key holiday shopping period from the start of November 2023 to the end of January 2024, which wound up with The Body Shop International, Searle said.

Searle said the parent company had taken $42.9 million from The Body Shop sa╣·╝╩┤½├ĮŌĆÖs accounts over that period and remitted $21.8 million for payables and payrolls.┬Ā

Searle called the administration filing ŌĆ£quite a shockŌĆØ and said the day it was made, he learned The Body Shop International would no longer continue cash pooling.

By then, The Body Shop sa╣·╝╩┤½├Į owed $3.3 million to landlords, utilities and logistics providers, insurers and marketing agencies. The Body Shop U.S. has about US$3.3 million in overdue payments, Searle said.

The Body Shop sa╣·╝╩┤½├Į felt it had to file for creditor protection last week because it was ŌĆ£faced with mounting debt, no prospect of assistance from the U.K. parent or Aurelius or return of its funds, and an inability to fulfil e-commerce orders,ŌĆØ he said.

ŌĆ£But for the improper withholding of the companyŌĆÖs funds, The Body Shop sa╣·╝╩┤½├Į would be able to pay all its obligations in full.ŌĆØ

The Body Shop U.S. announced it would cease operations on Friday. The Body Shop sa╣·╝╩┤½├Į is so integrated into the U.S. business that the closure will make it ŌĆ£exceedingly difficultŌĆØ for the Canadian arm to access inventory from its shuttering U.S. warehouse and process future requests, Searle said.

The company has also lost the ability to ship to its wholesale customers, Shoppers Drug Mart and Amazon.ca.

Shoppers Drug Mart has stocked Body Shop products since last summer, when the companies announced a partnership that would see merchandise, including its popular body butters, hit 25 stores. Another 25 locations were expected to roll out products this year.

The partnership marked the first time Body Shop products were sold in sa╣·╝╩┤½├Į outside the companyŌĆÖs stores.

This report by The Canadian Press was first published March 4, 2024.

Tara Deschamps, The Canadian Press