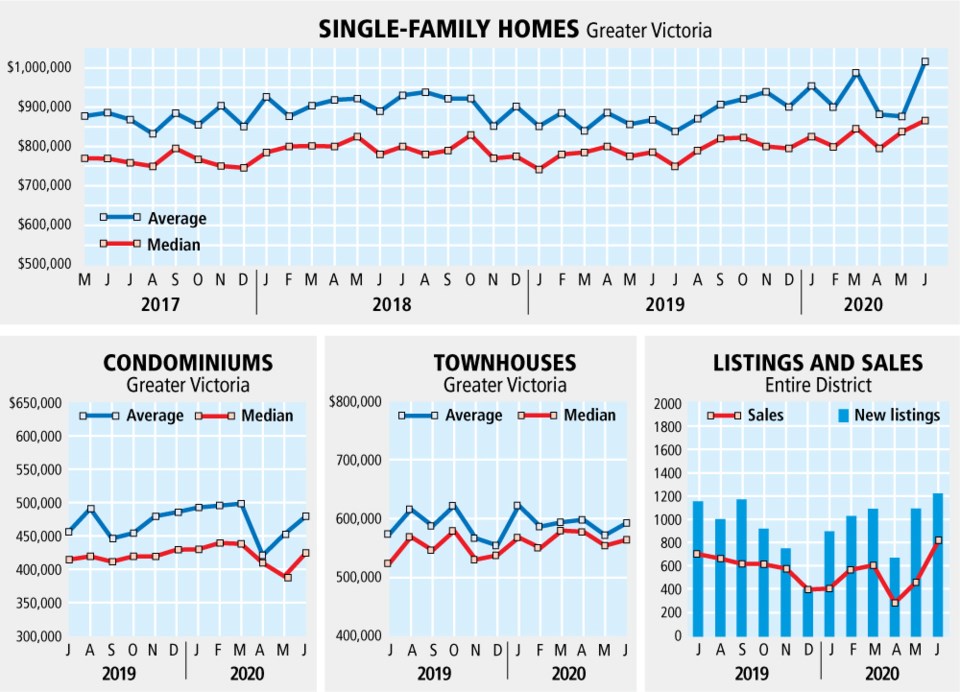

An unusually high number of luxury home sales in a busy June pushed the average selling price for a single-family home in Greater Victoria to more than $1 million for the first time.

The record of $1,014,746 beats out the previous high of $986,602 set this year in March.

“June was a very busy month for us. There was a lot of pent-up demand,” in the wake of the pandemic, Sandi-Jo Ayers, Victoria Real Estate Board president, said Thursday.

Realtors she has talked to who specialize in the luxury market say sa国际传媒 buyers are picking up the $1-million-plus properties.

Ayers described June’s number of luxury sales as “unique.”

A total of 23 single-family homes sold last month for more than $2 million each, Ayers said. Of those, six were more than $3 million.

Sales of high-end homes were significantly higher than June of last year when 11 sold for more than $2 million.

It is common to see single-family houses sell for more than $1 million in the capital region. Land prices, particularly on the waterfront, have pushed up property values for many years, making Greater Victoria one of the most expensive markets in sa国际传媒.

Prices have helped drive condominium construction throughout the region because many buyers cannot afford a single-family home.

Areas such as Oak Bay, North Saanich, Metchosin and Saanich East are among locations where single-family home prices are typically the highest.

For example, the value of 38 sales in Oak Bay reached $58.4 million last month. The total value of all 808 property sales for the entire board came in at $631.8 million for June.

When it comes to parsing numbers, Ayers cautions, “averages can be skewed based on some of the higher-end properties selling.”

Last month’s $1-million average was driven by those 23 sales, she said. The median (or mid-way) price for a single-family house in the region was lower, at $865,750.

Rather than relying on averages, the Victoria and other Canadian real estate boards use a system which they believe more accurately reflects the market. They look at the benchmark price, or home price index, which compares changes in value for a typical home in a specific area.

The benchmark value for a single-family house in the core area of Greater Victoria moved to $896,200 last month, up from $861,800 in June 2019. The core includes Victoria, Saanich, Oak Bay, Esquimalt and View Royal.

June’s 808 sales increased from May’s 457. The June sales also beat June 2019 sales of 740.

In contrast, May’s year-over-year sales were down by 46 per cent, the board said in its monthly market report.

Demand built up since March, combined with low inventory resulted in “multiple-offer situations which drive up some of the prices,” Ayers said.

While sales of single-family homes were up, condo sales declined slightly, by 3.2 per cent, with 209 units sold.

Even so, the benchmark price for a condominium in the core rose, to $525,600 last month, versus $519,100 for June 2019.

Concerns around strata insurance rates may have affected condo sales, Ayers said, adding that the province has announced it will bring in measures to tackle soaring rates.

Multiple and competing factors are influencing the real estate market, Ayers said.

Some buyers and sellers have been “highly active” as sa国际传媒 moved ahead in its restart program while others are returning more slowly, she said.

A ban that prevented sellers from being able to offer a vacant home which had had a tenant was lifted in late June. That move may bring more properties to the market, Ayers said.

The market has also seen active sales listings increase to 2,698 last month, up by six per cent from May. Inventory still remains below the same month last year.

New sa国际传媒 Mortgage and Housing rules, which came into effect this week, will reduce the borrowing power of buyers who insured through the federal agency, she said. That might have pushed some demand forward last month, although others do offer mortgage insurance.