New mortgage rules that came into effect Jan. 1 are likely behind the surge in home-buying activity toward the end of 2017, according to the Victoria Real Estate Board.

The rules, which require a stress test to ensure borrowers can withstand a jump in interest rates, fuelled strong sales last month as there were 462 property sales recorded in December following on the 671 sales recorded in November.

Ara Balabanian, president of the Victoria Real Estate Board, said those rule changes “may have pushed people into the market early.”

The result was a strong year for real estate overall, though it fell shy of the record-setting sales pace of 2016.

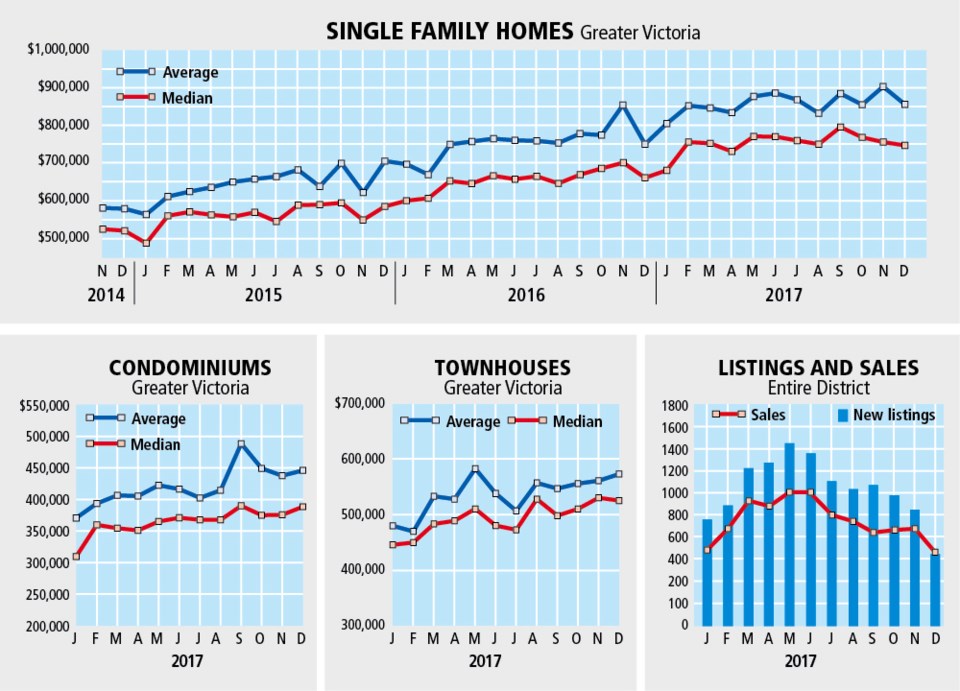

According to the board, there were 8,944 properties sold over the course of 2017 — 15.8 per cent fewer than the 10,622 sold in 2016.

“Early in 2017, we discussed how the Victoria area housing market would be different than the record-breaking year we had in 2016 and that, over the course of the year, we’d probably see a gradual return to a more balanced market,” Balabanian said.

“We did see evidence of this change come early in the year, as multiple offers and rapid price increases leveled out.

“However, the ongoing low inventory of properties for sale meant that buyers continued to experience competitive situations in high-demand areas, and multiple offers were still a common occurrence as buyers negotiated in a tighter market.”

There were just 1,384 active listings for sale at the end of December, a drop of 21.5 per cent compared with November and down 7.3 per cent from December 2016.

That is the lowest level of inventory for the region recorded in December since 1996, when the board started tracking that statistic.

“Overall, the low inventory and the continued interest in Victoria real estate meant that well-priced homes were quick to sell in 2017,” Balabanian said.

“Moving forward, we expect to see more inventory come into the market, which will continue to move us toward a more balanced state.

“We also expect housing prices to remain stable, without the increases we tracked in 2016, and anticipate steady slow growth.”

Beyond Greater Victoria, the rest of Vancouver Island saw a slight drop in sales activity over the course of 2017.

Despite a busy December, when 327 properties changed hands, there were 5,612 sales last year north of the Malahat Drive, a seven per cent decrease from the 6,059 recorded in 2016.

According to the Vancouver Island Real Estate Board, that decrease in sales reflects the market returning to more normal levels from the unprecedented sales activity generated in 2016.

It also reflects the lack of inventory as there were just 762 single-family homes on the market in December, the lowest number recorded since the board started tracking inventory levels in 1999.

The supply of condominiums and townhouses dropped by 13 per cent and 33 per cent, respectively.

Board president Janice Stromar said consumers are still motivated to buy.

“My advice to prospective sellers is not to delay listing their home until the spring,” she said.

“The VIREB area has been a sellers’ market for a long time, but we know that it cannot continue indefinitely.”

Last month, the benchmark price of a single-family home in the VIREB area reached $466,400, up 17 per cent from one year ago.

The benchmark price of a condominium last month rose to $284,400, up 28 per cent and the benchmark price of a townhouse hit $370,700, a 23 per cent increase from December 2016.