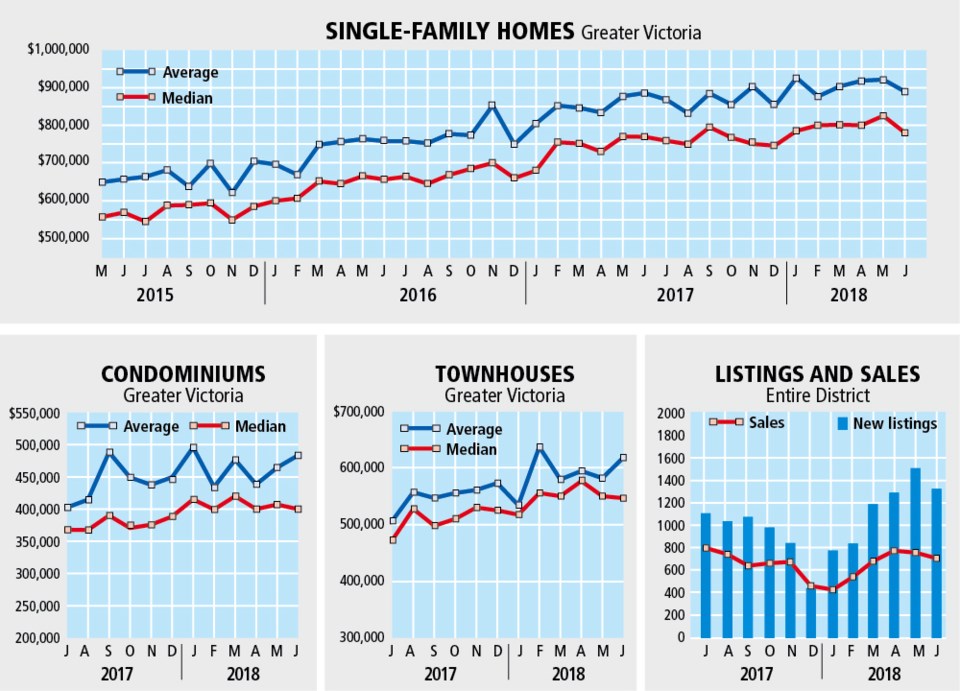

Greater Victoria real estate sales are down from the same month in 2017 for the seventh month in a row as the once-hot market cools. A total of 708 properties sold through the Victoria Real Estate Board’s multiple listing service in June. That’s a 29.8 per cent drop from June 2017, when 1,008 changed hands.

Single-family home sales slid by 34.7 per cent and condominium sales declined by 25.1 per cent from June 2017, the board said in its monthly report, released Tuesday.

Real estate sales are moving at a slower pace and homes spend more time on the market, board president Kyle Kerr said. There are fewer multiple-offer situations.

If more properties come up for sale in the coming months, that could create a more balanced market, Kerr said.

A total of 2,595 properties are for sale, an increase of 35.5 per cent compared with 1,915 listings in June of last year. Even so, the higher number lags behind the 10-year average of 4,100 listings.

Kerr said more stringent federal lending rules and provincial tax measures, such as the upcoming speculation tax, are “dragging the market down” this year. The board normally releases the benchmark price for homes within the region, but that data was not immediately available.

It released average prices, showing that the average for a single-family house in Greater Victoria was $889,097 in June. The average for a condo was $483,570, and the average for a townhouse was $617,862.

Sarah West, a real estate agent at Royal LePage Coast Capital Realty, said the region remains a seller’s market, even though it is starting to moderate.

“Certainly houses under $700,000 are still moving quickly and condos under $500,000 are still moving quickly.”

Fewer properties are selling for above the asking price, West said.

“Even with this slight hint of any sort of moderation in the market, a lot of buyers are just stepping back to see how things shake out over the next little bit.

“There’s not that same frenzy that we saw in the last two springs. Some buyers are just not willing to get into multiple offers and are willing to let a property go to wait for something else to come up.”

West figures that those in the market have a handle on the new federal mortgage rules which came in early this year, followed by sa国际传媒’s property transfer tax and foreign buyer tax.

The big unknown remains sa国际传媒’s promised speculation tax, which is “causing a pause in the market,” she said. That tax, targeted at urban centres, is slated to be imposed in the fall and full details are yet to come.

Homeowners who do not spend the majority of their time at their property and leave those homes empty will have to pay the tax.

West said she has lost three or four sales because of the impending tax in the past few months and other clients are mulling over whether to sell or not.

Andy Stephenson, a real estate agent with Southeby’s International Realty sa国际传媒, said he is optimistic about the market because people from elsewhere in the country will continue to want to move here.

He is concerned about the effects of new provincial taxes, fearing that they will discourage Canadians from outside sa国际传媒 from moving here. Victoria has been a destination for buyers from provinces such as Alberta, who spend part of their year in this region.

Those part-time residents support local businesses while here, Stephenson said. “I’ve got some people who are considering leaving Victoria — they have part-time homes here.”