For Millennial would-be homebuyers who don’t have the luxury of a Bank of Mom and Dad, the hurdle of saving for a down payment in sa国际传媒’s pricey real estate markets can often be insurmountable.

This is borne out by a by real estate website Point2Homes, released July 31, which examined how long it takes the average Millennial to save for a down payment in cities across sa国际传媒.

The study found that Metro Vancouver is home to four of the country’s five most out-of-reach housing markets, with West Vancouver at the top and Vancouver proper in second place.

For a Millennial saving 20 per cent of their earnings each month (based on average household income per Millennial couple for that city), it would take a whopping 35 years to save a minimum down payment on the median price of a West Vancouver home. However, this study does assume that the Millennial couple is buying a $2.54 million home.

Vancouver follows in second place, with a mimimum down payment on a median-priced Vancouver home taking 20 years to save on an average Millennial couple's income. Burnaby and North Vancouver are in joint fourth place in the country, both at 16 years, and Richmond is in seventh place at 14 years.

Victoria was way down the in 31st place out of 100 cities, taking just 2.7 years to save for a down payment, and Prince George was in 65th place at exactly one year.

The survey also found that, despite a minimum down payment on a median-priced home in Vancouver coming to $283,346, would-be homebuyer Millennials in Vancouver who were surveyed said they typically expect to save under $100,000.

Point2Homes said that these were “unrealistic expectations” and that unless Millennials were counting on parents to make up the shortfall, they were in for a “rude awakening.”

However, the study does not take into consideration that most Millennial couples in Vancouver would be unlikely to spend $1.4 million on their first home, which being over $1 million requires a minimum 20 per cent down payment. For context, a minimum five per cent down payment on a $500,000 starter condo would be $25,000 (although with a five per cent down payment, another $19K would be required for mortgage default insurance, which is added to the mortgage.)

If a Millennial couple were saving 20 per cent of their $72,390 annual income, it would take just 1.7 years to save a $25,000 down payment. However, strict mortgage qualification rules mean that a couple on this income would not qualify for a $475K mortgage – no matter how much they saved as a down payment, they would still only qualify for a mortgage around $283K.

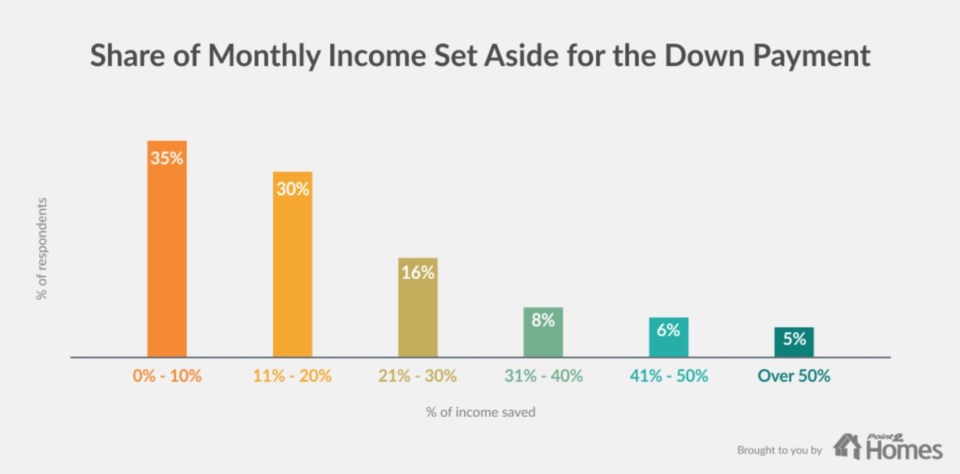

Moreover, most Millennials surveyed said they were not saving as much as 20 per cent of their income. Across all the national respondents, 35 per cent said they were putting aside less than 10 per cent of their gross earnings, 30 per cent said they were saving 11-20 per cent, and just 35 per cent said they were saving more than 20 per cent.

Point2Homes listed 40 Canadian cities that are affordable for Millennials looking to get into homeownership. Timmins, Ontario, was at the top of the list, at just five months to save a down payment. Trois-Rivières, QC, and Cape Breton, NS, follow suit, with only six months needed to save for a down payment, followed by Edmonton, AB, and Québec City, QC.

Avis Devine, associate professor of real estate at the Brookfield Centre for Real Estate and Infrastructure, said, “The greatest hurdle to homeownership – for Millennials as well as all generations – is affordability. In many urban cases, this is rooted in limited supply in desirable locations, leading to price increases.”