High land prices contributed to a paucity of land deals in Metro Vancouver last year, with a new Colliers report underscoring how little values have come off for both industrial and residential development sites.

“Buyers have stayed on the sidelines as cost of land, labour, and financing makes it difficult to inject capital into projects. For example, Vancouver has seen the price per acre rise 33 per cent since 2020 to over $4 million,” Colliers reported in its survey of land markets across the country, released May 23. “This increase in cost, in tandem with long wait periods from acquisition to development, has led to only 218 acres sold in 2023.”

Residential land values peaked at $4.5 million in 2022 as transactions soared past 600 acres in the initial flush of post-pandemic optimism.

But this remains off the peak of nearly 1,900 acres transacted in 2018, pointing to a cautious attitude among investors.

“They’re extremely price sensitive, because what pencils today, the financials could change due to cost of labour, cost of materials, financing costs,” said Susan Thompson, associate director of research with Colliers in Vancouver. “Any sort of legislative change on zoning requirements, that could change the equation substantially.”

While there’s good demand for residential development land given the need for housing, the economics aren’t working for anyone along the value chain, from developer to homebuyers.

“They want to set their financials and go, ‘This project is going to make money,’” Thompson said of developers. “There’s pencils down because they just can’t make the financials make sense.”

Whether or not the Bank of sa国际传媒’s interest rate announcement June 5 moves the needle at all is an open question. While observers are now leaning 60 per cent in favour of a cut, whether or not it’s significant enough to bring investors off the sidelines is another question.

The entitlement process remains challenging, Thompson notes, pointing to the need for a stabilization in development policies as well as the financing environment.

“We need to see some stabilization in policy, and a change in the interest rates,” she said.

Similar trends are seen for industrial land, with transaction volume falling from 600 acres in 2022 to less than 200 acres last year. Meanwhile, values have stuck at $4.7 million an acre.

“Industrial is a wild one,” Thompson said. “Prices per acre ran up a long way in industrial in the past few years and it has not cooled off, just because of the scarcity of land.”

A similar gap between sellers and purchasers exists in residential because of divergent expectations of value. With market fundamentals unchanged, there’s no need to reduce values in the way buyers expected.

“That’s misaligned some expectations of people who were hoping to buy when the market cooled down. The prices didn’t come down the way they thought they would,” Thompson said. “It’s more of a normalization.”

While distress sales are an opportunity, and have shown up in residential land first, Thompson said. The rest of the market has been more constrained, with few opportunities to buy and good buyer when the numbers pencil out.

“The land market in general – industrial, commercial, residential – is just very tight compared to a lot of other markets because there is such a scarcity of land,” she said. “There’s a lot of pent-up capital out there that are looking for good deals. Everybody’s waiting to see who’s going to be the first mover and where the deals are going to get done.”

One area that’s seeing activity is the Fraser Highway corridor between Surrey and Langley along the route of the planned SkyTrain extension.

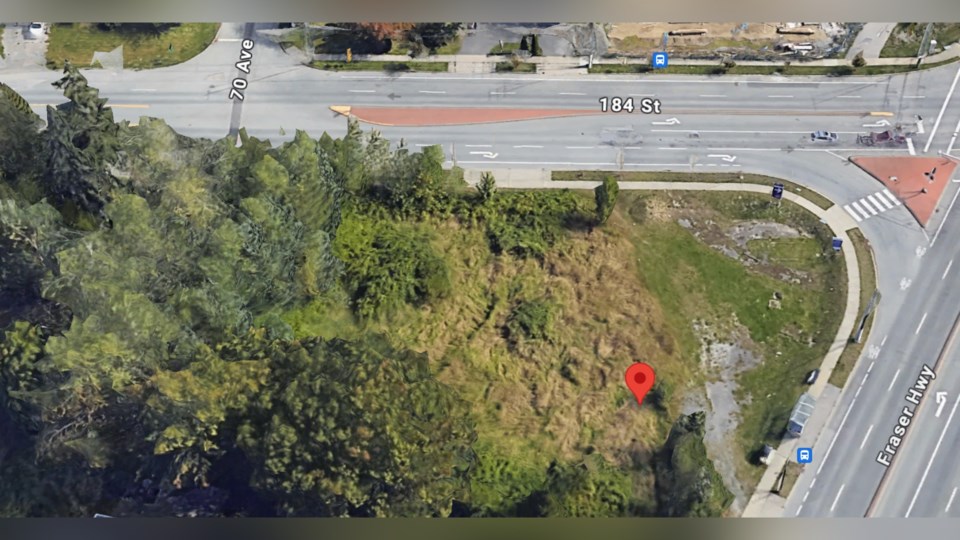

Joe Varing of Varing Marketing Group in Abbotsford has sold a number of properties in the area, among them 18375 Fraser Highway, which the province acquired March 27 for the SkyTrain project as well as an affordable multifamily housing development.

“The Fraser Highway corridor has demonstrated some notable resilience and activity,” Varing said. “We've observed several key developments that highlight its activity. For example, multiple new mixed-use real estate projects have been initiated in the last quarter alone.”

The SkyTrain line as well as changes to land use plans in the Tynehead, Smith and Brookswood areas have fuelled the activity.

“While the broader market remains flat, the Fraser Highway corridor is poised for continued growth,” he said. “With several high-profile projects slated for completion in the next year, we anticipate this trend to not only continue but possibly even accelerate."