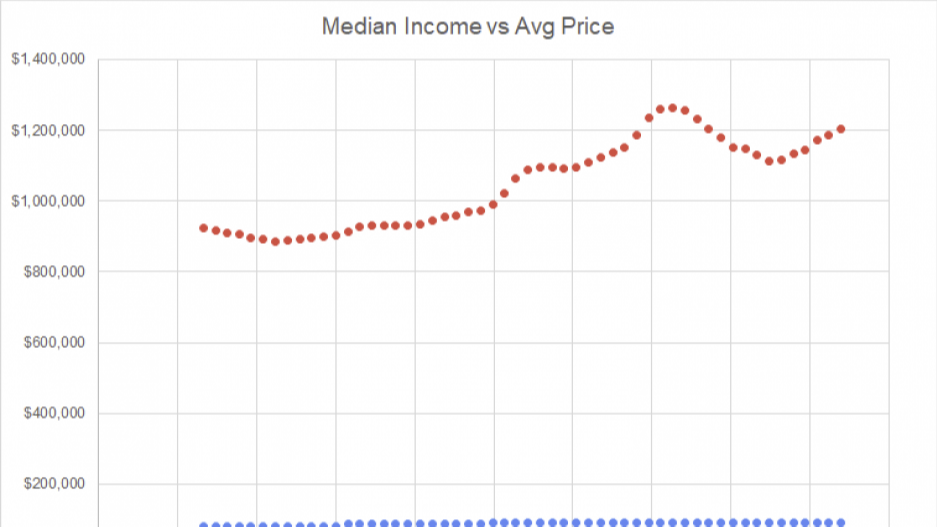

The disparity between income and home prices has become more pronounced over the past four-and-a-half years, according to newly released data.

The result is a widening housing affordability gap.

Housing prices have increased by roughly 26.4 per cent across saąúĽĘ´«Ă˝ between January 2019 and June 2023.

Over the same time period, the median income for a Canadian has risen by just 9.6 per cent, according to data gathered by real estate listing website Zoocasa.

“I think Canadians expect incomes to go up with inflation as well as home prices. You also have to factor in mortgage rates that are a lot more unpredictable. Nobody expected interest rates to come down as far as they did during the pandemic and also to come up as much as they have,” said Patti Cosgarea, a spokesperson for Zoocasa.

The relationship between median income and the average home price in saąúĽĘ´«Ă˝ remains detached, despite measures to correct part of the Canadian housing market and interest rate hikes to battle inflation.

“It’s representative of an underlying element of our affordability challenge – that affordability is not attached to income, it's attached to borrowing,” said Andy Yan, director of Simon Fraser University's City Program.

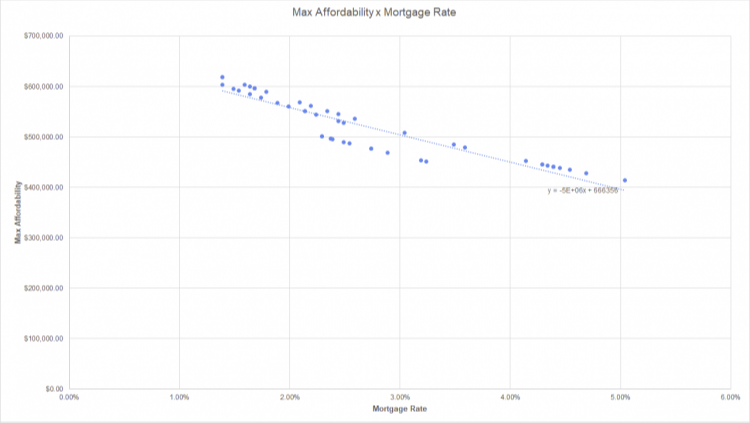

The above graph compares maximum affordability, or the maximum purchase price a homebuyer with that income could afford, with mortgage rates. Credit: Andy Yan, Zoocasa.

Zoocasa gathered data over the last five years that compares average housing price, median income and mortgage data.

This was used to determine an individual’s maximum affordability – the maximum purchase price a homebuyer with a certain level of income could afford with a 25-year amortization on a five-year fixed-rate mortgage. The price of a down payment would influence this data, said Cosgarea.

Every half-point increase in interest rates results in a $30,000 decline in borrowing capacity, according to the model used by Zoocasa to analyze the data.

Between January 2019 and June 2023, maximum affordability for median income earners in Vancouver has decreased by roughly $40,000, according to Cosgarea.

“It's really interesting to see maximum affordability increase steadily and peak in January and February of 2021. Then as the mortgage rates started to creep up, you can see that the maximum affordability comes down quite quickly,” she said.

In February 2021, an individual with an income of $89,530 buying a home worth $1,021,000 at an average five-year fixed mortgage rate of 1.39 per cent could afford to take on $618,551.43 in debt.

In June 2023, the median income is unchanged, but the average price of a home is $1,203,000. With a five-year fixed mortgage rate of 5.04 per cent, the amount of debt a buyer could take on is $413,813.99 – a decrease of 33 per cent.

Going forward, leadership that can “mind the gap” that is worsening is needed, Yan said.

​