sa国际传媒’s forest industry says it is concerned about the America-first posture U.S. President Joe Biden struck in his State of the Union address Tuesday.

In his speech, Biden highlighted a new policy that would building materials on federal infrastructure projects to be made in America.

“While this is concerning and we are seeking to better understand what this means for Canadian producers, our focus remains on working on both sides of the border to maximize the opportunity sa国际传媒 has in providing the sustainably produced, low-carbon lumber products we know American homebuilders, consumers and construction workers want and need,” said Linda Coady, president of the BC Lumber Trade Council in a statement.

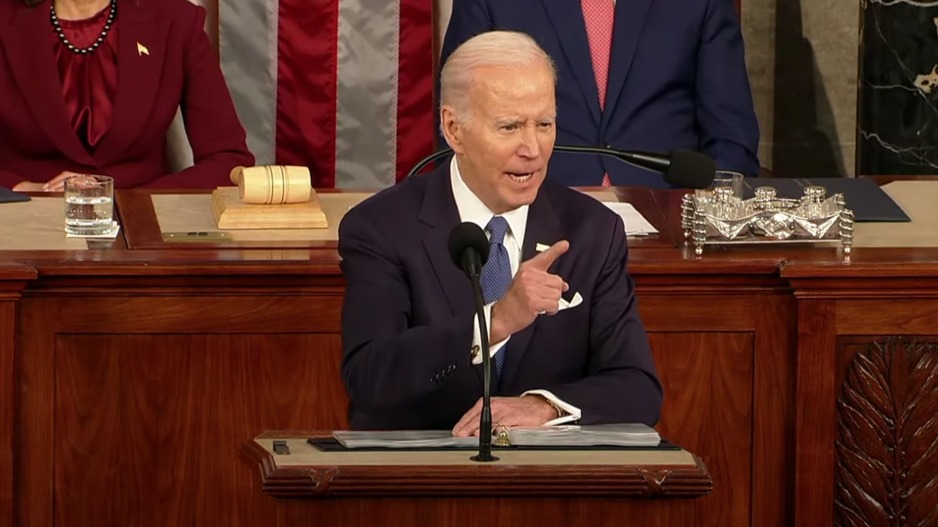

Biden delivered his second State of the Union address Tuesday, an annual speech made inside the U.S. House of Representatives, often highlighting the president’s goals and achievements. Biden highlighted some economic nationalist notes in his speech adopting the American First stance of his predecessor, highlighting the need to buy American and repatriate global supply chains.

“We’re making sure the supply chain for America begins in America,” said Biden in the State of the Union address.

Beyond the growth in manufacturing jobs, Biden also highlighted a bill passed earlier this year that provided US$280 billion to boost American semiconductor manufacturing. He then announced new standards to require all construction materials in federal infrastructure projects to be made in the U.S.

“American-made lumber, glass, drywall, fibre optic cables,” said Biden. “And on my watch, American roads, American bridges and American highways will be made with American products.”

While the industry is concerned about the announcement and is monitoring the situation, Paul Quinn, paper and forest products analyst with RBC Capital Markets, says the impact will likely be minimal as he suspects that federal U.S. infrastructure projects make up less than 10 per cent of the market. However, lumber prices could still raise slightly with the increase in demand, according to Quinn. He also highlighted that many Canadian companies have U.S. sawmills. So while Canadian mills might be affected, companies more broadly won’t be.

In her statement, Coady and the BC Lumber Trade Council seemed skeptical about the practicality of relying solely on American lumber. American lumber producers could only supply 70 per cent of the country’s domestic lumber demand according to Coady. Unsurprising, the 30 per cent shortfall of 15 billion board feet was largely filled by Canadian lumber, of which sa国际传媒 accounts for roughly 25 per cent.

sa国际传媒’s forestry industry is expected to shrink along with available timber supply, according to Quinn. He says new sawmill capacity is being introduced almost exclusively in the southern United States. Despite these market changes, he only projects the U.S. being able to grow its supply to only 80 per cent of its needs and thus having to rely on lumber imports.

"It’s a bit of a moot point as Biden can harp on buying U.S., but they can’t produce it all,” said Russ Taylor, president of Russ Taylor Global forestry consulting firm.