This is the second in a series of four articles resulting from a months-long investigation into Paper Excellence, a sa���ʴ�ý-headquartered pulp and paper company that has quickly grown to control large tracts of Canadian forests and become the largest company of its kind in North America. The stories are part of , an investigation led by the involving 140 journalists from 27 countries.

On the shores of Sea Island in Richmond, sa���ʴ�ý, a nondescript glass-walled building takes on the appearance of a staircase to nowhere. A short distance upriver, rafts of timber cut from British Columbia’s forests are floated toward the sea.

Inside the office building, Paper Excellence lists its global headquarters next to a life insurance firm and a canned tuna company. Following a spate of multi-billion acquisitions, the pulp and paper outfit is poised to become the largest forestry products company in North America.

But according to former employees and leaked communications, the Canadian offices have at times seemed to function as little more than a shell for work handled overseas by Asia Pulp and Paper (APP), the forestry arm of the Sinar Mas Group.

For decades, the Sino-Indonesian conglomerate has faced allegations of widespread environmental destruction. But Paper Excellence has received less scrutiny, even after the company made a series of multi-billion-dollar acquisitions and gained control of more than 22 million hectares of Canadian forests.

As part of a global investigation with partners at the International Consortium of Investigative Journalists (ICIJ), Glacier Media has analyzed 15 years of public documents, corporate filings and lobbyist records linking Paper Excellence with APP.

Both companies say they are independent from one another.

“Paper Excellence is owned solely by Jackson Wijaya and is completely independent from Asia Pulp & Paper,” said a company spokesperson in a written statement.

But leaked communications together with interviews with former employees show staff worked freely between Paper Excellence and APP. One former employee, who asked to remain anonymous, said he was recruited by Paper Excellence from India, sent to APP facilities in Indonesia for several months for training and company “indoctrination,” and then flown to work at a Paper Excellence pulp and paper mill in British Columbia.

“The real brains were all in Shanghai,” said a former manager at APP's Shanghai offices, who Glacier Media agreed to keep anonymous. “Jackson [Wijaya]’s floor was on top. The Paper Excellence guys would be closer to them. The bottom people would be working for APP. They kept their cards close to their chest.”

Glacier Media and its ICIJ partners have confirmed at least 13 people have worked for APP and Paper Excellence, many at the same time. Among those are senior members of Paper Excellence‘s leadership.

Companies linked by 15-year paper trail

The paper trail connecting the two companies’ staff stretches back to 2006, when Paper Excellence said it would buy its first mill in Saskatchewan. Early corporate filings show one of the mill’s first directors listed his address at Sinar Mas’s Indonesian headquarters. And in multiple letters to Saskatchewan’s regulator, the company wrote on letterhead bearing the Sinar Mas name.

A spokesperson for Paper Excellence downplayed the apparent significance. He told the ICIJ “your decade-old letterhead and employees that worked for both companies in the early years” were the result of Jackson Wijaya benefitting from family relationships when he established the company.

“But eventually Jackson was able to get Paper Excellence to a point where it was able to proceed alone, without anything more than normal and appropriate business relationships, predominantly through third-party sellers,” the spokesperson said.

Fifteen years later, Paper Excellence has expanded to nearly 40 pulp and paper mills across sa���ʴ�ý, the U.S., France and Brazil. Its latest US-$2.7 billion deal for Montreal-based Resolute Forest Products — completed this month — gives Paper Excellence control of over 22 million hectares of Canadian forest and turned the company into the largest forestry company in North America.

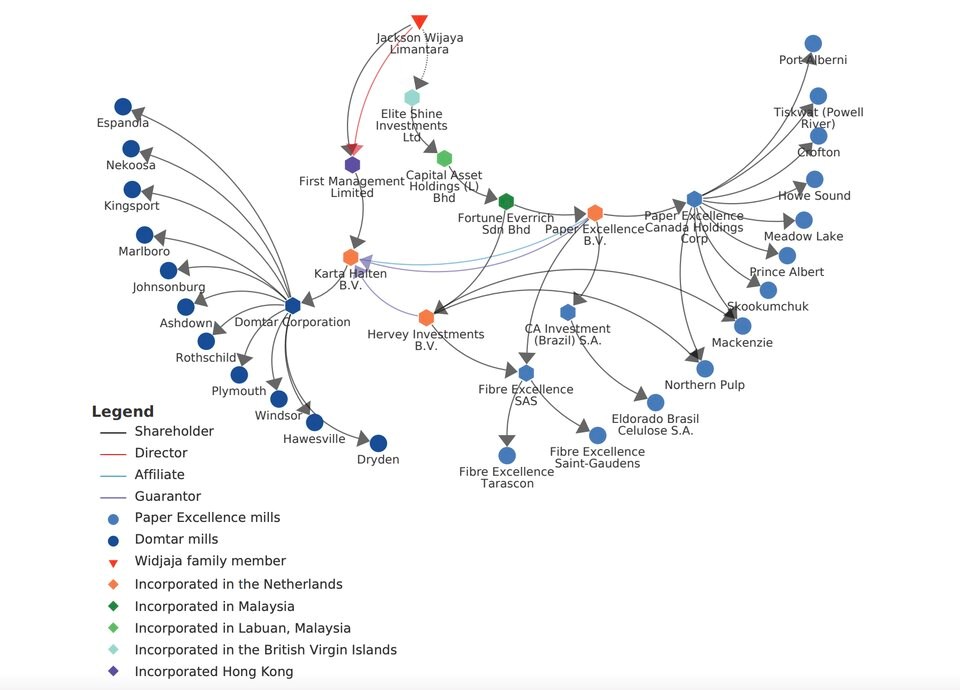

With every acquisition, Paper Excellence’s corporate ownership structure has ballooned into a complex web of holding companies registered in jurisdictions like Hong Kong, the Netherlands and Malaysia. That corporate structure was sketched out in an October 2022 led by the Environmental Paper Network.

Glacier Media and its ICIJ partners reviewed that paper trail — which included hundreds of public records across multiple holdings linked to Paper Excellence — and then went further.

Corporate filings indicate Elite Shine Investments Ltd., a British Virgin Islands registered entity, is the ultimate owner of Paper Excellence. That jurisdiction does not reveal shareholder information.

But a filing with the U.S. Securities and Exchange Commission (SEC) says Paper Excellence B.V. is “indirectly 100% owned by Jackson Wijaya.” And both Government of sa���ʴ�ý’s Inter-Corporate Ownership database and the international business database Orbis describe Paper Excellence as an arm of the Sinar Mas/APP conglomerate controlled by the Widjaja family.

“Nobody other than Jackson has ever been or is the ultimate owner or controller of any of the companies in Paper Excellence. No other company or person has ever had any ownership interest in any of the Paper Excellence Group’s entities,” said a Paper Excellence spokesperson when asked to explain the links.

Corporate filings also suggest Wijaya has simultaneously headed Paper Excellence while holding senior positions with Asia Pulp and Paper, the forestry arm of his family’s business empire. From 2008 to at least 2017, a bond offering filed with the Hong Kong Stock Exchange shows Wijaya acted as director of Ever Dragon Investments Group Limited. That company ultimately owns 100 per cent of the shares for all seven APP mills in China.

An APP spokesperson said Wijaya “has never been the CEO of APP China” and has never “had decision-making authority with respect to APP China.” A Paper Excellence spokesperson also denied Wijaya was ever CEO of APP China.

Property records filed in sa���ʴ�ý over the past three years indicate Wijaya's principal residence is in Kowloon, China, and that he is not a permanent resident or citizen of sa���ʴ�ý. When asked where Wijaya resides, Paper Excellence said “Jackson spends time in the Americas, Europe and Asia as business demands.”

Paper Excellence turned down an ICIJ request to interview Wijiya. Rarely seen in public, his ties to British Columbia are many. sa���ʴ�ý’s Land Owner Transparency Registry lists at least 240 properties under Wijaya's name. Some of the properties listed under his name include:

- At least 1,700-acres of cattle ranch on the south shore of Kamloops Lake;

- A $63.5-million commercial parcel in Coquitlam off United Boulevard;

- A 25-acre lot zoned for manufacturing in Prince George;

- And a $6.8-million slice of land in Surrey between the railroad tracks and the Fraser River.

“Jackson Wijaya established Paper Excellence in 2006 with a dream to build a strong business in the pulp and paper industry in the Americas and Europe,” said a Paper Excellence spokesperson when pressed further over the apparent overlaps with APP.

According to overseas corporate registries and filings with the U.S. SEC, the Paper Excellence name never existed until 2008 — two years after Wijaya embarked on his “dream.”

Leaked emails show two companies worked together during takeover

The tangled web connecting Paper Excellence and APP also appears to have extended to APP’s headquarters in Shanghai, documents indicate.

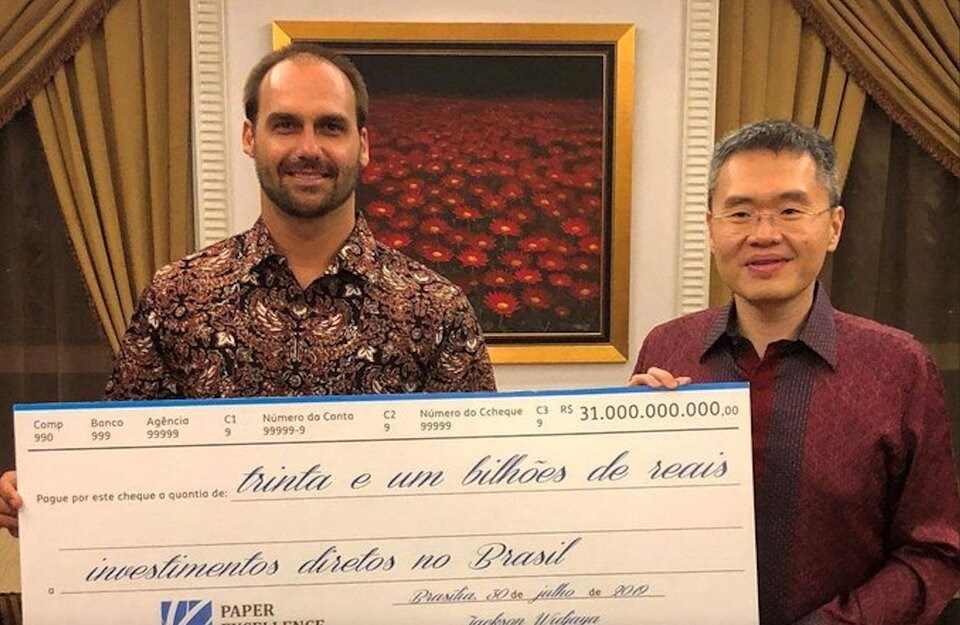

Leaked emails show APP employees helped guide Paper Excellence’s application to Chinese regulators in 2017 and 2018, during its initial planned takeover of the Eldorado mill in Brazil.

One former middle manager at APP said Paper Excellence executives would regularly go back and forth between sa���ʴ�ý and APP’s Shanghai offices.

“They would come to China and we would discuss strategy with them,” said the former employee, who spoke to Glacier Media on condition of anonymity. “It was all part of the game. We were all incestuous over there.”

Emails show senior staff from APP and Paper Excellence worked together to build market forecasts, prepare answers for China’s anti-trust regulator and arrange Canadian pulp shipments to directly supply APP mills.

In one September 2017 exchange, Paper Excellence’s vice-president of pulp sales Edwin Widjaja provides APP deputy general manager Richard Pho with a five-year pulp price forecast. In another, Pho tells his Paper Excellence counterpart to stockpile warehouses with FSC-certified North American pulp for their Indonesian “sister mills.”

Pho writes “...don’t sell anything yet.”

“I am holding all offers now,” responds Widjaja.

When presented with these findings, an APP spokesperson said “We do not exchange private information with Paper Excellence.”

“APP has not shared confidential information with Paper Excellence. Nor has its employers engaged in any work with Paper Excellence,” the spokesperson added.

Paper Excellence did not answer ICIJ questions about Paper Excellence and APP employees appearing to collaborate on submissions to anti-trust regulators.

Richard Schwindt, a former investigator with sa���ʴ�ý’s Competition Bureau who reviewed the leaked communications and the companies’ ownership structure, said the level of corporate obfuscation is unlike anything he has seen in his long career.

“It's quite clear from the communications that are going on that they're chatting about everything, including investments and pricing,” said Schwindt. “This is a connection, clearly.”

“Quite frankly, I've just never seen this.”

Schwindt says it does not appear Paper Excellence has violated any anti-trust laws in sa���ʴ�ý. But Chinese regulators may face a different situation: Paper Excellence’s planned purchase of Brazil’s Eldorado mill — the full takeover is still held up by a court injunction in Brazil — would put Paper Excellence into the Chinese market, where APP already has a massive footprint. If the two companies are indeed part of the same corporate group, the acquisition would suddenly give APP a significant share of both China’s pulp market and imports.

Other evidence turned up during ICIJ’s investigation indicates at least one arm of the Chinese state was deeply invested in Paper Excellence’s finances.

Emails from 2017 show Edwin Widjaja communicating with Pöyry Management Consulting Inc. — a firm that at one time described Paper Excellence as “a subsidiary of Asia Pulp and Paper”—about two Chinese banks being investors. .

Widjaja asks Pöyry to secretly produce global pulp market price forecasts for two state-owned Chinese banks.

“Who are the investors that will receive the forecast?” wrote a Pöyry consultant.

“They are China Development Bank and Industrial and Commercial Bank of China (ICBC),” responded Widjaja.

Paper Excellence entered agreement with China Development Bank

It’s not entirely clear how Paper Excellence has financed its expansion in recent years, but corporate filings hold some clues.

Paper Excellence told Glacier Media in 2023 most of its current financing for its North American operations comes from “well-established financial institutions in sa���ʴ�ý and the United States.”

Several U.S. and Canadian banks — including Barclays, Royal Bank, Bank of Montreal and CoBank — put up a combined $3.45 billion in loans for the company’s Domtar and Resolute acquisitions, SEC filings confirm. CoBank is part of the U.S. Farm Credit System under fire of late for providing loans to non-U.S. citizens.

A deeper look into historic land titles and overseas corporate registries shows early funding being provided by the China Development Bank, a major state-owned lending institution that finances overseas energy and resource exploitation. The bank also backs major infrastructure projects like the Belt and Road Initiative and Chinese enterprises “going global.”

In 2012, land title documents show mortgages were registered on three Paper Excellence properties — the Howe Sound, Meadow Lake and Mackenzie mills. At the same time, the three mills issued a US$1.25-billion demand debenture with the China Development Bank.

A demand debenture works like a line of credit, holding an entire company’s assets — from the land, to trucks, computers and machinery — as collateral, explains Ron Usher, lawyer and general counsel for the Society of Notaries Public of BC.

“It's just like a mortgage over everything,” said Usher.

It’s not clear how much other Paper Excellence property was put up as collateral for the debenture.

Margaret McCuaig-Johnston, a former assistant deputy minister at Natural Resources sa���ʴ�ý, told ICIJ partner the CBC the China Development Bank often offered loans that don't “seem too difficult or too threatening to a government” but that later morph into control by a Chinese company or one that backs Chinese interests.

“The China Development Bank has been critical, not just in sa���ʴ�ý, but in Africa and South America,” said McCuaig-Johnston, now a senior fellow at the University of Ottawa’s Institute for Science, Society and Policy.

“It's often one of the first organizations in the door when China wants to enter a market and acquire resources in another country.”

sa���ʴ�ý’s former ambassador to China Guy Saint-Jacques says the debenture came at the end of a period when the Chinese government was pushing to back state-owned enterprises and private Chinese companies around the world. Companies were tasked by the Chinese state to secure access to everything from minerals to oil and gas and forest products, said the ambassador.

“They know where they want to go. They are very systematic. And I think we were a bit naive in protecting our industries, in understanding where they were going, the risk,” Saint-Jacques told ICIJ partner the CBC.

By 2019, China was the fourth largest source of foreign direct investment in sa���ʴ�ý, and according to one tally by the University of Alberta’s China Institute, had poured $93 billion into the country. But by then, Chinese investment had increasingly become strategic, focusing on “small and beautiful projects,” as Saint-Jacques described them.

Land titles show debt shifted to Indonesian state-owned bank

In 2020, the China Development Bank discharged its agreement on three Paper Excellence mills, documents show. Mortgages and debentures on the Howe Sound and Meadow Lake mill have since been transferred to PT Bank Mandiri.

PT Bank Negara Indonesia, another state-owned bank, holds a US$350-million mortgage on several Paper Excellence properties, spanning its Surrey Distribution Centre and the company’s Crofton, Port Alberni and Powell River mills, land titles show. The Indonesian bank also holds a separate a $100-million mortgage on its Skookumchuck mill.

Paper Excellence told Glacier Media in 2023 the Indonesian debt is “only a small fraction of outstanding loans” and that the company has “no outstanding financing agreements with any China-based institutions.”

According to Usher, debenture financing agreements are a normal lending tool for powerful companies to finance big acquisitions. If an agreement goes wrong, the lender can spark a legal process that could end in the sale or seizure of all properties and assets. Where the Paper Excellence deals differs, Usher said, was with the lender.

“China has had a very conscious policy of investing in infrastructure and resource projects all over the globe. So it's really a matter of national decision. It's really a federal government response,” he said. “What are we comfortable with? What do we want to do?”

Now a senior fellow at the China Institute, Saint-Jacques says the ties to state-owned Chinese and Indonesian banks raise fair questions about the security of Canadian natural resources.

“It is concerning when huge swaths of forests are being taken by a company, that's not a Canadian company per se, maybe registered in sa���ʴ�ý, but it's owned by foreign interests who have Chinese partners and who could decide at a moment's notice to export everything to China and Indonesia,” added McCuaig-Johnston.

At a global level, public financial statements show APP and Paper Excellence would have a combined annual revenue of more than $34 billion, dwarfing any other pulp and paper company in the world.

Schwindt, formally of sa���ʴ�ý's Competition Bureau, says evidence Paper Excellence and APP are part of the same corporate group does not mean the Canadian operator will repeat the bad behaviour APP is alleged to have inflicted on the forests of Indonesia.

But according to some pulp and paper workers interviewed for this story, the financial relationships do raise questions over who is exercising sway over sa���ʴ�ý’s forests and the people who work in them.

Former Paper Excellence employee Mac Anderson said he was concerned about market dominance: “they are going to control things.”

Others, like former Crofton millwright and union leader Gary Fiege, see the company’s expansion as the best bet for a rural worker trying to support a family and pay a mortgage. He said it’s hard to be critical of a company like Paper Excellence when others have walked away.

“We’ve been foreign owned for a long time,” he said. “We’re the hewers of wood and drawers of water.”

“At some point, we need to look after ourselves.”

This is the second in a four-part investigation into Paper Excellence, carried out in collaboration with the CBC, Halifax Examiner, Le Monde and Radio France. The stories are part of a wider journalistic collaboration led by the under the banner

Read about the rise of Paper Excellence in , how it has gained political influence in , and in , how Paper Excellence's sustainability pledges match evidence on the ground.