This is the first in a series of four articles resulting from a months-long investigation into Paper Excellence, a sa���ʴ�ý-headquartered pulp and paper company that has quickly grown to control large tracts of Canadian forests and become the largest company of its kind in North America. The stories are part of , an investigation led by the involving 140 journalists from 27 countries.

On a clear January evening just before midnight, a Panamanian-flagged cargo ship slipped into a berth south of Vancouver, sa���ʴ�ý Amid the vessel’s containers, longshoremen loaded 540 tonnes of wood pulp drawn from thousands of hectares of local forests.

Satellite images and marine tracking technology later show the 294-metre MSC ELA slicing through the Pacific Ocean at over 18 knots. Over a month later, the ship pulled into the port at Shanghai.

At first glance, the pulp shipment from Paper Excellence’s Skookumchuk mill appeared routine — over the last decade, the East Kootenay facility has almost exclusively shipped its pulp to Indonesia and China, according to third-party audits.

Shipping data shows much of the mill’s pulp has gone to buyers with obscured corporate ownership. The January pulp cargo was sold to PT Asia Trade Logistics, a company that according to bills of lading has purchased over 200 shipments from Skookumchuck in recent years.

A deeper look into the logistics company shows it is owned by the same indirect shareholders as a flagship unit of Asia Pulp and Paper (APP), the forestry arm of the Sino-Indonesian conglomerate known as the Sinar Mas Group.

A spokesperson for APP denied ever buying pulp “directly” from Paper Excellence. Both companies told Glacier Media they are independent from one another.

APP has been a regular target for a coalition of environmental watchdogs known as “.” The group, which includes WWF-Indonesia, has produced several reports alleging APP is a major contributor of deforestation in Indonesia. Some of the company’s wood suppliers, they say, have also sparked large wildfires, helping to cement Indonesia as the fourth largest contributor of greenhouse gases.

Evidence APP has links to Paper Excellence has grown in the last six months. An October 2022 — jointly produced by Environmental Paper Network, Woods & Wayside International, Rainforest Action Network and Greenpeace — drew on a wide array of public records to provide “strong circumstantial evidence” the two companies belong to the same corporate group.

Since then, a Glacier Media investigation carried out with partners from the International Consortium of Investigative Journalists (ICIJ) — including the CBC, Halifax Examiner, Le Monde and Radio France — has built on that body of evidence, linking the sa���ʴ�ý-headquartered company with the Indonesian business empire. The investigation is part of , a journalistic collaboration bringing together 40 media outlets in 27 countries to examine deforestation and greenwashing.

Interviews with former employees, an analysis of leaked emails, and a vast array of public documents spanning 15 years all suggest Paper Excellence and APP share a deeper relationship than has previously been reported.

The investigation comes amid Paper Excellence’s meteoric rise. On March 1, the company completed a US$2.7 billion takeover of Resolute Forest Products. The deal makes Paper Excellence the largest forestry company in North America and gives it control of least 22 million hectares of sa���ʴ�ý’s forests — an area nearly seven times the size of Vancouver Island.

“That's an incredible amount of corporate concentration,” said Nicole Rycroft, executive director of Canopy, a Vancouver-based organization that works with over 900 major brands to create sustainable forestry supply chains.

“I mean, that is huge and clearly unprecedented.”

Proponents of the company’s expansion say Paper Excellence is buying mills and keeping jobs alive at a time when no other company will. But critics warn the company’s rapid growth and privatization of publicly traded companies threaten to obscure who is influencing the future of the sa���ʴ�ý's forests.

On the ground, Skookumchuck’s latest shipment is part of what former workers and industry insiders describe as a direct pipeline quietly funnelling biomass from Canadian and French forests to APP’s operations in Indonesia and China. That raises fundamental questions over who should control the country's forests.

“It’s a fibre grab,” said one former manager at APP’s Shanghai offices, who spoke on condition of anonymity.

“They want to keep the perception that Paper Excellence is an asset of sa���ʴ�ý for sa���ʴ�ý and by sa���ʴ�ý, but in reality, it's a feeder for the Chinese machine.”

Rise of a forestry giant

Most trace Eka Tjipta Widjaja’s first business venture to his teenage years. Upon immigrating to Indonesia from China, he got his start “selling cookies from a rickshaw,” according to a 2018 briefing note to then premier John Horgan.

In the coming years, a 2019 Bloomberg obituary said Widjaja honed his early business acumen hawking coconut and palm oil on the streets of Makassar.

Today, the Widjaja family is worth US$10.8 billion, according to . The Sinar Mas Group does business in real estate, financial services, agribusiness, palm oil, mining and coal production, and telecommunications. But pulp and paper represent the biggest part of the conglomerate’s business.

By the late 1990s, Sinar Mas’s forestry arm, APP, had bought or built pulp and paper mills across several Indonesian islands and the Yangtze and Pearl River deltas in China.

There have been some serious bumps along the way. In 2001, Sinar Mas defaulted on nearly US$14 billion in bonds and loans, the largest corporate default in the history of emerging markets. The Widjaja family engaged in a protracted battle with creditors and managed to maintain corporate control.

A spokesperson for APP said it has since paid all its international creditors “in full.” The company says it now sells its paper products across 150 countries, including sa���ʴ�ý. Environmental groups like WWF-Indonesia, Greenpeace and Woods & Wayside International say those operations have come at a cost, including the alleged clearing of — an area roughly the size of Israel — by 2011.

In the early 2000s, however, APP's environmental record hadn’t yet , an international certification body touted as the best tool to ensure companies are engaged in sustainable forestry practices.

At the time, British Columbia was emerging as a testing ground to expand FSC certifications to companies with weaker environmental records, an has found. Companies like APP benefited from the laxer rules, which allowed them to brand their pulp and paper as sustainable.

Through multiple investigations and reports, several environmental groups — including and — warned APP continued to contribute to deforestation and the conversion of carbon-rich peatlands into pulpwood farms to feed its mills.

Sinar Mas pushed back. In 2006, as part of its first big global PR campaign, the company took out a full-page advertisement in the New York Times and the Times of London describing APP’s commitment to “conservation beyond compliance.”

“Asia Pulp & Paper and Sinarmas Forestry (APP) are committed to protecting high conservation value forests,” the ad stated.

That same year, APP made its first big move into sa���ʴ�ý, announcing it would purchase Saskatchewan’s Meadow Lake Mechanical Pulp Inc., which had gone into receivership, for $38 million.

“One of the world's largest and most controversial pulp and paper companies is the buyer for Meadow Lake Pulp,” a reporter for the Prince Albert Daily Herald wrote in late 2006.

Don Roberts, managing director for CIBC World Markets, told Regina Leader Post that APP didn’t have enough fibre to feed its Asian mills.

“The reality is that Asia is short of fibre,” he told the publication.

Back in Indonesia, evidence APP was was piling up. And the world’s preeminent sustainable forestry certification body was forced to act.

In October 2007, the FSC announced it would , and the next month, terminated its sustainability certificates across multiple holdings in Asia. Within 24 hours, the certification body approved Paper Excellence’s certificate for its Meadow Lake mill, documents show.

The FSC had helped stain the Asian pulp giant with a reputation for deforestation. But in North America, one member of the Widjaja family had gained a green foothold.

Paper Excellence expands as rainforests fade

Paper Excellence began its first rapid expansion in 2010, buying up mills in France and sa���ʴ�ý By 2021, the company had bought 10 mills across sa���ʴ�ý, each giving the company access to the kind of FSC-certified softwood fibre that was becoming increasingly scarce.

Some of that wood came through government pulpwood contracts; most was guaranteed through long-term agreements with private suppliers, or in land deals bought with government-borrowed money.

Paper Excellence has at times created its own wood supply companies, like the Mackenzie Fibre Management Corporation. At one point, the fibre supply company had licences to directly control the harvest of more than 1.36 million cubic metres of sa���ʴ�ý wood.

“Paper Excellence is owned by a company called Sinar Mas,” company head Mac Anderson told a in 2012.

“They'll keep this place running, even if they have to subsidize the mill to keep it up and going, because they need that fibre.”

Meanwhile, APP was trying to redeem its image. It approached FSC International saying it had “undergone fundamental changes.” But allegations the company was in direct conflict with Indigenous communities continued.

In one 2008 incident, reported an APP subsidiary worked with police to forcibly remove 300 Sakai Indigenous villagers from their homes. The villagers had allegedly been in a land dispute with the subsidiary since 1996, when the government gave the company industrial tree farming rights. Afterwards, authorities and the company bulldozed the village to the ground, alleged the rights group.

That year, APP was the world’s fifth largest tissue producer, selling its paper products across the planet to retailers like KFC and Walmart, and under brand names like Fiora, Paperline, Inspira and Zenith. But several major global brands had joined a growing boycott against Sinar Mas’s palm oil operations.

APP says its supply chain has been “deforestation free” since it launched its in 2013. At the time, the company said it had withdrawn from working with companies that cut high-conservation value forests. The company also says it has made significant progress on human rights in recent years. According to its latest , APP resolved 61 per cent of conflicts it had with local communities in 2021.

In the past, Indonesian wood suppliers have drained and burned swampy forest and peat land to expand plantations. That allows them to plant and harvest fast growing tree species to feed pulp mills. But it also fundamentally changes the landscape.

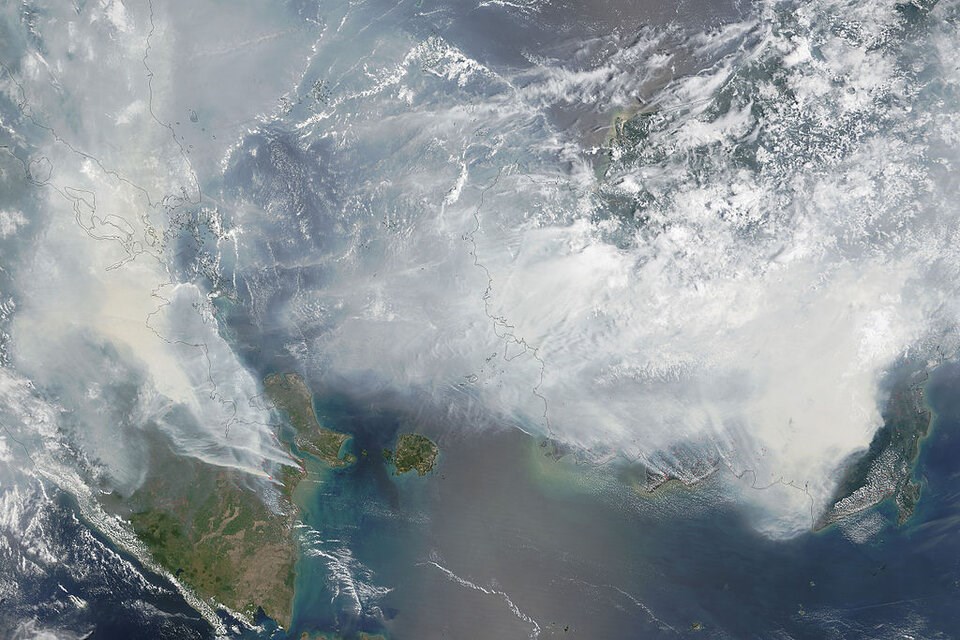

In 2015, a strong El Niño combined with slash-and-burn land use practices helped drive a that blanketed the region in smoke and may have hastened the deaths of more than 100,000 people throughout Southeast Asia, according to led by researchers at Harvard University. By one count, the fires are estimated to have caused .

A 2017 Associated Press investigation reported Sinar Mas exercised significant influence over a network of 27 wood suppliers linked to deforestation and wildfires. APP later released a saying it was linked to some of the companies. Caught within the smoke, the Singaporean government into four of those companies.

APP says it has improved its practices in recent years, setting aside more than 20 per cent of its concessions for conservation. The pulp and paper company says it uses on-the-ground surveillance and satellite information systems to monitor forests for illegal logging and fires throughout its forest concessions.

Amid environmental offences, growing denial over foreign links

Paper Excellence’s expansion across North America, Brazil and Europe came with growing denials it had any links to Sinar Mas or APP, according to public records and former employees.

By 2012, Anderson said employees were increasingly warned not to mention connections with APP. When he built roads and installed bridges, he sometimes had to report expenditures or capital items to bosses with either APP or Sinar Mas in China.

“Guys at Shanghai were reviewing what I was doing,” he said.

At the same time, Anderson said the company struggled to adjust to sa���ʴ�ý’s environmental regulations. In 2016, the Canadian government handed a $225,000 penalty to the company’s Northern Pulp mill for leaking more than 47 million litres of pulp and paper effluence into Pictou Harbour, N.S.

Two years later, federal authorities fined its Mackenzie, sa���ʴ�ý, mill $900,000 for leaking effluence into a lake. Both mills were added to sa���ʴ�ý’s environmental offenders registry.

The Skookumchuck mill, meanwhile, has faced nearly $175,000 in penalties for environmental infractions, including leaking toxic effluence into the Kootenay River in a series of events that killed local fish.

Mills close as fibre runs short

Many of Paper Excellence's acquisitions during its early expansion included mills bought at bargain prices.

Some of the company’s sa���ʴ�ý mills started running short on fibre — a combination of the province’s own growing wildfire problem, northern pine beetle infestations and decades of industrial logging.

“I think we are witnessing a crash of epic proportions,” said Ben Parfitt, a forestry expert and policy analyst with the Canadian Centre for Policy Alternatives. “Too much in the province has been logged too quickly.”

In 2014, Paper Excellence bought a mill in Chetwynd with the promise to “be here for a century — as far as Asia continues emerging,” deputy CEO Pedro Chang said at the time. The next year, the company said it was moving to shut the mill, laying off 109 people in the process.

In 2021, the same year Paper Excellence bought Domtar and its holdings across sa���ʴ�ý and the U.S., the company shut its Mackenzie and Powell River mills, citing “a lack of economical fibre” and economic conditions that were “simply not viable.”

It was “a grab,” said Anderson. “They were gonna outsmart the rest of us... And they didn't understand the costs of operating in sa���ʴ�ý as opposed to some of the Asian countries.”

Since then, Paper Excellence has only ramped up its acquisitions beyond sa���ʴ�ý, something Anderson said was always part of the plan. Within sa���ʴ�ý, Anderson said the calculation was different — so long as Paper Excellence were among the last few players in the province, the company could still secure the fibre it needed on the West Coast.

This year, Paper Excellence overtook its competition to become the province’s largest pulp producer, capturing more than 30 per cent of capacity, according to the BC Pulp and Paper Coalition.

Meanwhile, exports to China have skyrocketed over the past decade, accounting for two-thirds of all sa���ʴ�ý’s pulp exports by 2021. Today, more pulp flows through sa���ʴ�ý than anywhere else in sa���ʴ�ý.

A strategic Canadian resource

Eventually, some of that pulp will return to sa���ʴ�ý. It arrives in your mailbox as junk mail, on your doorstep hugging a toaster you bought off Amazon, or rolled up on a dispenser under your kitchen sink. Without it, going to the bathroom would be a very different experience.

In an increasingly digitized world, it might sound counterintuitive, but pulp — and the paper it produces — feeds an industry forecast to grow at a steady clip over the coming decades, according to forecasts.

Newspapers used to drive much of that demand. Today, packaging, tissues and toilet paper, and new construction materials are pushing the industry’s expansion. But the pulp market faces stiff competition. Some companies are sourcing wood fibre to manufacture an alternative to single-use plastics. Others are clamouring to access sa���ʴ�ý‘s forests in a bid to produce wood pellets, and power what industry touts as a cleaner alternative to gas or coal.

“It’s a myriad of end uses that are stable and growing,” said Joe Nemeth, project manager for the BC Pulp and Paper Coalition. “This stuff is needed worldwide.”

“That ain’t going away.”

First you need wood — and not just any wood. Most of the pulp used to make toilet and printing paper comes from hardwoods harvested in vast quantities in the tropical forests of Indonesia or Brazil. In those hot and humid climates, trees grow like weeds in short spurts all year long, says Nemeth.

Move closer to the poles and swings in temperature mean trees shoot up in seasonal bursts, leaving long, malleable fibres. By blending the two, paper companies can maximize the softness of hardwood pulp with the rip-resistance and high-absorption qualities softwood brings to all sorts of packaging and hygiene products.

“It's the rebar for paper,” as Brian McClay, chair of the pulp market data firm TTOBMA, described it to ICIJ partner the CBC.

The only problem, say industry experts, northern softwood pulp can only be produced in cool climates like sa���ʴ�ý, Scandinavia and Russia.

“For a long time, Russia was considered to be the next frontier for softwood capacity growth,” said Pierre Bach, a researcher with the London-based pulp and paper consultant Hawkins Wright.

Last year, Russia’s invasion of Ukraine sunk the possibility the country’s vast forests could be tapped as a source for northern pulp — at least for a generation, agreed McClay and Bach.

Without any obvious opportunities to expand elsewhere, several experts said industry eyes are increasingly falling on sa���ʴ�ý as a strategic source of softwood.

“I think it’s a very smart strategy,” said Nemeth, pointing to Paper Excellence’s recent acquisitions. “They buy mills for strategic reasons — so they can control the fibre.”

“They want to be that last man standing.”

This story is the first in a four-part investigation into Paper Excellence carried out in collaboration with the CBC, Halifax Examiner, Le Monde and Radio France. The stories are part of a wider journalistic collaboration led by the under the banner

Read about the about the evidence linking Paper Excellence with Asia Pulp and Paper in , how the company has gained political influence in , and in , how Paper Excellence's sustainability pledges match evidence on the ground.