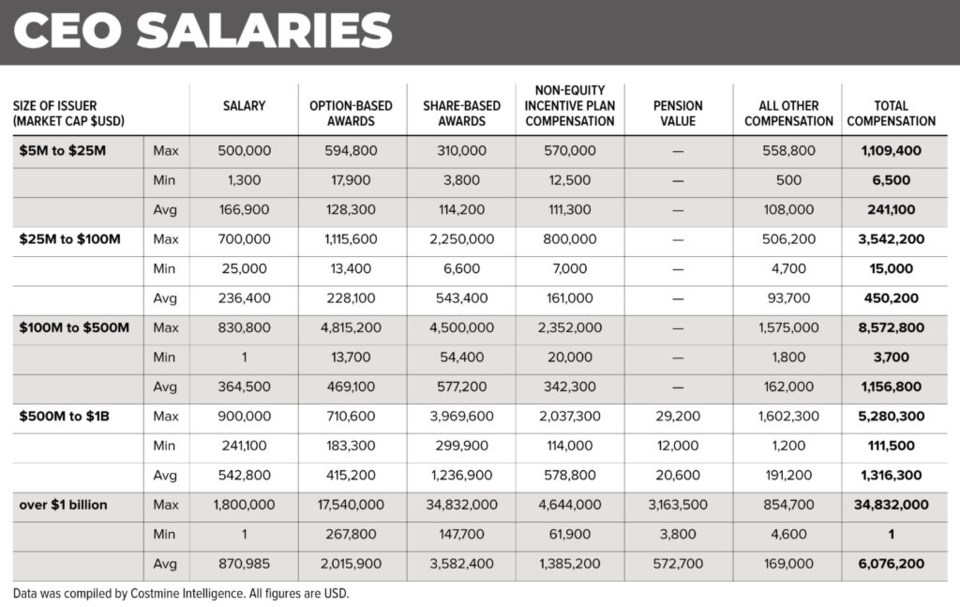

A whopping US$35 million. That’s what the highest paid mining company CEO earned in 2021, according to data collected by Costmine Intelligence, part of The Northern Miner Group.

The survey also found the average CEO salary for companies with market values of more than US$1 billion to be US$7.8 million a year. Costmine collected the executive compensation data from regulatory disclosures by more than 200 publicly listed Canadian and American mining companies.

Two CEOs accepted just US$1. The survey results are confidential, but one of these executives was likely McEwen Mining (TSX: MUX; NYSE: MUX) CEO Rob McEwen. He describes himself as “chief shareholder,” taking only a US$1 salary and having invested US$220 million personally in the company.

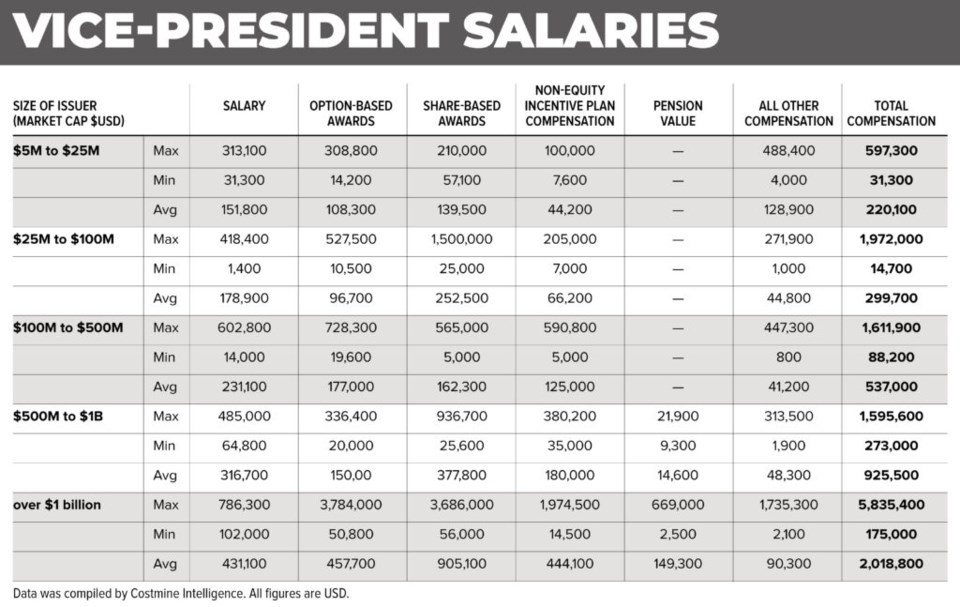

Vice-presidents working for the largest U.S. companies earned a maximum of US$5.6 million a year down to US$242,000 per annum, the report showed. The survey broke down responses by company valuation, from US$25 million to US$100 million, US$100 million to US$500 million, $500 million to $1 billion, and beyond.

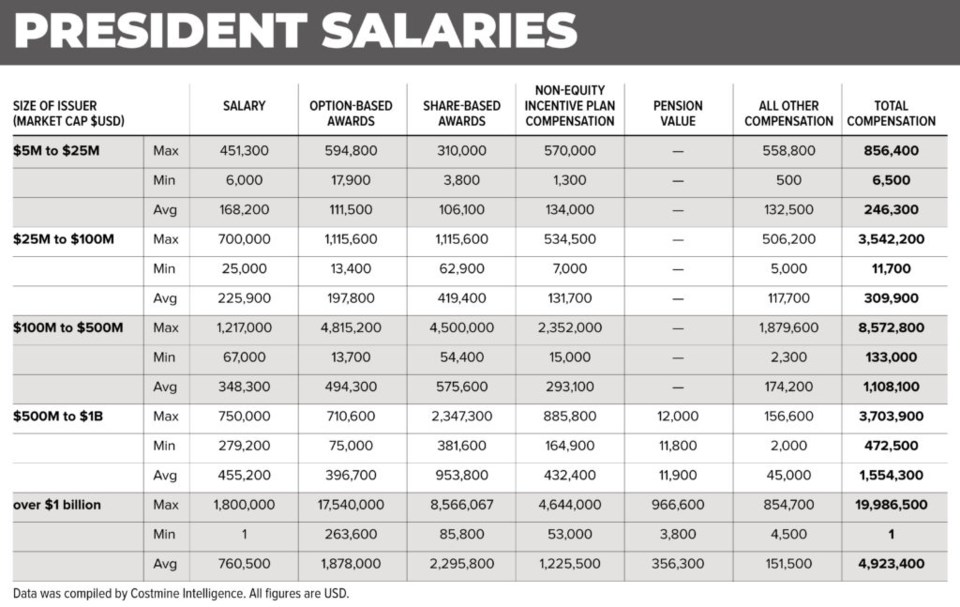

As noted in the tables below, stock options and share-based rewards played large roles in executive compensation. As well, non-equity incentive plan compensation kicked in for companies with a market value larger than US$100 million. The executive salary component is part of the larger trend showing labour costs will soon beat oil as a mine’s biggest expense.

Costmine also collected wage and salary by questionnaires submitted by 128 U.S. mines, of which 51 were industrial mineral and aggregate mines, 56 were metal producers and 21 were coal mines. In sa国际传媒, 73 mines participated in the survey.

One mine reported offering big game hunting privileges to employees and family as a benefit. Another offered pet insurance. More common benefits included safety equipment and tool allowances, uniform rental, transportation and/or room and board for remote mine sites.

There were also retention bonuses, scholarships for dependent children, education and training assistance, adoption assistance, matching charitable gift programs and health club memberships.

There are a handful of companies that anticipate the executive will make up the difference in no salary with hefty stocks and option packages. Costmine does not track salaries that are reported as ‘nil,’ however compensation through stocks, options, and “other” is accounted for.

Because of this, the average total compensation column in the tables may be smaller than the number in the salary column. Regarding the tables, Costmine notes that total compensation represents the minimum and maximum for individual companies and does not add across columns.