TORONTO ŌĆö sa╣·╝╩┤½├Į's main stock index rose on Friday, as strength in financial and technology stocks helped outweigh weakness in energy, while U.S. markets rose to a solid finish after a day of mixed trading.

The Dow notched another all-time high for the last trading day of the month, up 228.03 points at 41,563.08, while the S&P 500 neared its own recent record, rising 56.44 points to 5,648.40. The Nasdaq composite was up 197.20 points at 17,713.62.

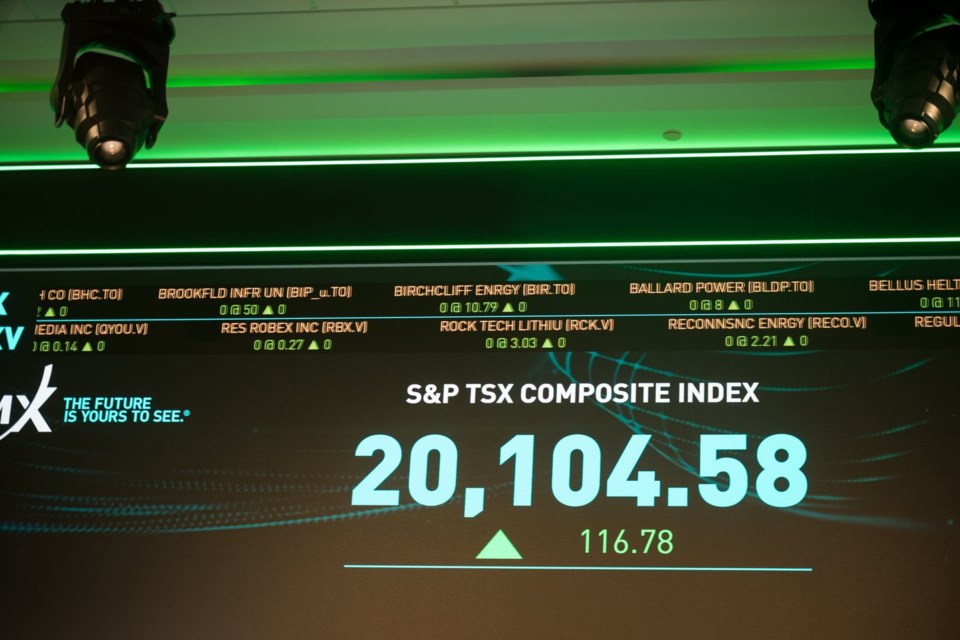

The S&P/TSX composite index closed up 118.69 points at 23,346.18.

Markets ended the month of August on a quiet note, said Anish Chopra, managing director with Portfolio Management Corp., setting investors up for a September that promises interest rate cuts on both sides of the border.

The Commerce DepartmentŌĆÖs personal consumption and expenditures report Friday showed prices rose just 0.2 per cent from June to July, with the annual inflation figure unchanged at 2.5 per cent. The annual number had been expected by economists to edge higher.

ŌĆ£It shows that inflation continues to moderate and is getting closer to that two per cent Federal Reserve target,ŌĆØ said Chopra.

ŌĆ£It adds some support to the probability of a U.S. Federal Reserve interest rate cut in September,ŌĆØ he said.

Market bets are currently anticipating a 25-basis-point cut by the central bank next month, according to data from CME Group.

Ahead of the central bankŌĆÖs decision mid-September, investors will be eyeing the next jobs report in the U.S. next week, said Chopra, as thatŌĆÖs been a ŌĆ£big concernŌĆØ for market watchers over signs of weakening.

ŌĆ£Based on what we've seen here in the recent past on employment data, it looks like employment in the U.S. is softening. So there is concern there,ŌĆØ he said.

In sa╣·╝╩┤½├Į, the latest GDP report showed economic growth was stronger than expected in the second quarter.

ŌĆ£sa╣·╝╩┤½├Į's economy grew faster than expected in (the second quarter) at 2.1 per cent but there was some concern about economic weakness over the summer,ŌĆØ said Chopra.

Like in the U.S., ŌĆ£the odds are favouring a 25-basis-point cut for sa╣·╝╩┤½├Į next week," he said.

The Bank of sa╣·╝╩┤½├Į has already cut interest rates twice as its economy weakened faster than the U.S.ŌĆÖ under the weight of rate hikes. The Fed has yet to start cutting its key rate.

The Canadian dollar traded for 74.12 cents US compared with 74.22 cents US on Thursday.

The October crude oil contract was down US$2.36 at US$73.55 per barrel and the October natural gas contract was down a penny at US$2.13 per mmBTU.

The December gold contract was down US$32.70 at US$2,527.60 an ounce and the December copper contract was down a penny at US$4.21 a pound.

This report by The Canadian Press was first published Aug. 30, 2024.

ŌĆö With files from The Associated Press

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

Rosa Saba, The Canadian Press